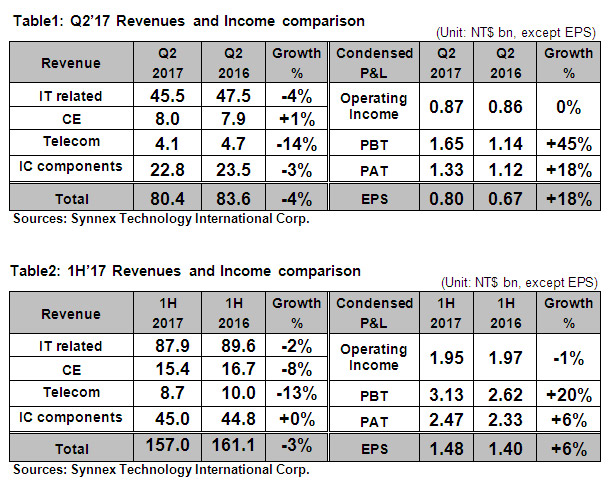

<Electronics stocks News>The performance for Q2’17 after the review by CPA: Consolidated PAT was NT$1.33bn and EPS was NT$0.80 with a significant increase of 18%YOY from last year. 1H’17 consolidated PAT was NT$2.47bn and after-tax EPS was NT$1.48, with a growth of 6% YOY from the prior year. For the consolidated revenue, Q2’17 and 1H’17 consolidated revenue was NT$80.4bn and NT$157.0bn which was slightly lower than the same period in the last year due to the appreciation in TWD. If excluding the foreign exchange effect, the YOY growth would be 2% and 3%.

Overall speaking, the market of the first-half for 2017 was still under expected. Specifically during Jan/Feb for Chinese New Year, the buying power was below expectation, and the changes in consumer demand, as well as the fluctuation in TWD, resulted in the difficulties in operation. The performance of Synnex has been relatively stable, as strategic actions have been put forward to focus on the commercial market by continuously developing new market as well as new customer and yet to increase the market share at the consumer market. By the product aspect, Q2’17 IT sales revenue reached the second high record in the history. Among the IT products, consumer PC and commercial product both remained the high level comparing to last year. The expansion in market share of DIY component and advance graphic card led to growth 5% YOY, and broke the highest record over the same period. For the IC component, though severe shortages, Synnex has strived to gain the priority and preferred allocation and efforts in developing products and customers in IoT, as well as broke the second high record in the history. By the geographic segment, the consolidated revenue converted in TWD was slightly lower than the same period in the last year due to the appreciation in TWD. If conversion into original currency, all the revenue in China, Hong Kong, Australia, New Zealand, Bestcom were higher than the prior year. Furthermore, the revenue in China and Hong Kong grew 13% and 10% YOY respectively, and Bestcom also hit the historical high record over the same period.

For the operating performance, due to the benefits from the increase in high-end and commercial products, the expansion of new business field, and the improvement in product management, the gross margin ratio showed growing trend, and came to 3.54% in Q2’17 and 3.72% in 1H’17, both increased by 0.18% YOY from the same period in last year. Besides, core joint venture business in US, India, Middle East, Thailand, all made brisk performance. Q2’17 and 1H’17 investment income amounted to NT$0.40bn and NT$0.81bn respectively, with 37%YOY and 27%YOY. Furthermore, Q2’17 PBT was NT$1.65bn with a growth of 45%, and 1H’17 PBT was NT$3.13bn with 20%YOY due to the well cost management contributed.

Looking forward to 2H’17, new products will successively launch, including Apple iPhone, Samsung Note 8, Microsoft Surface and xBox, adding the Data Center solution, cloud service, IoT, and the third-party logistic service, all the new fields, new products and services will continue to contribute the profit. Synnex is looking forward to enjoying the growing revenue for the next half year of 2017.

In addition, Synnex BOD resolved the ex-dividend date on August 28th and the payment date expected to be on September 22nd. The cash dividend is NT$1.0 per share.