<Electronics stocks News>

Synnex announced the latest performance for Q2 and 1H of 2018 after the review by CPA. Consolidated revenue and profit both grew significantly with stunning performance, hitting the historical high record.

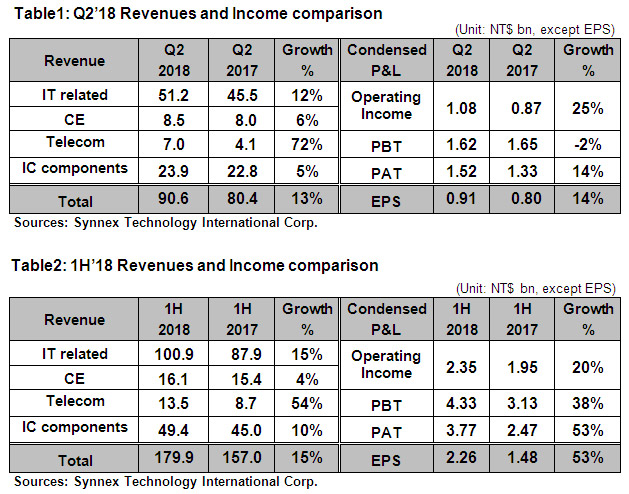

The consolidated revenue for Q2’18 was NT$90.6bn, with growth of 13%YoY, hitting the consecutive four quarters highest record in the same period. Consolidated PAT was NT$1.52bn, with growth of 14%YoY. For performance in 1H’18, revenue reached to NT$179.9bn, with growth of 15% YoY, as well as breaking the new high record. PAT totaled to NT$3.77bn, with significant growth of 53%YoY, the new record in the first half year as well. EPS for Q2’18 and 1H’18 was NT$0.91 and NT$2.26 respectively.

For the core product, Synnex kept robust growth and continuous expansions in market share through the strength in comprehensive channel in recent years. In the meantime, outstanding result from cloud, AIoT and smart devices related new product fields, as well as the optimization in operation efficiency, all bringing Synnex revenue and profit performance soared in 1H’18.

By geographic prospect, Synnex maintain the growth momentum from Q1’18 with double-digit growth. Among them, China grew 16%, Taiwan grew 19%, Australia, New Zealand, Indonesia and Hong Kong as well as grew from 10% to 12% YoY.

By products aspect, for the core products, due to enterprise and government endures digital transformation and enhancement of information security, data center related products, such as server/storage, networks security, and software grew 21% YoY. Thanks to eSports hot trend, bringing upgrade demand for storage, graphic card, high-end and large-size monitor, the grew came to 18% YoY. Mobile phone market gradually changed from operator subscription contract to unlock phone, sales revenue growth reaching 72% YoY.

For the new products: since Synnex Cloud Service Platform launched in 2016, the revenue had continued strong growth and was reaching to 63%YoY in Q2’18, with more than 160 thousand active subscribers. AIoT, smart speaker, drone and VR related products grew 182%YoY due to the successful introduction of global notable brands and continuous expansion in new application.

Looking forward to 2H’18, although the market might be disturbed by numerous uncertain factors, the recently announced of July’18 revenue kept aggressive growth of 14% YoY, the robust performance is still maintained. Synnex follow new channel service model and market operating strategies in multi-products, multi-channels, multi-markets, and the new strategies have leaded into new growing cycle and consecutively expanding market shares. 2H’18 revenue performance is still expected to have a substantial growth compared with the 1H’18 revenue.

In addition, Synnex BOD resolved to declare cash dividend of NT$2.2 per share, and set the ex-dividend trading date on August 22nd.