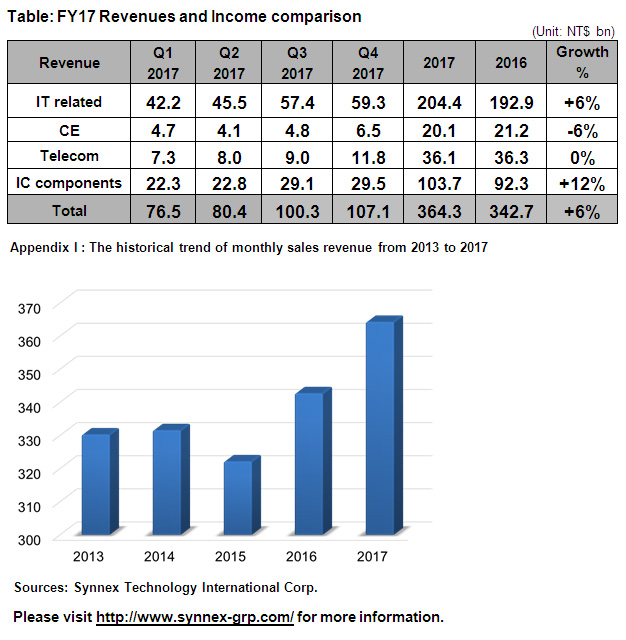

Synnex preliminary consolidated financial results were as follows:

Synnex consolidated FY17 sales revenue was NT$364.3bn, breaking the new historical high record again, with growth of 6% YOY, If excluding the foreign exchange factor, annual growth would reach 10%. FY17 global revenue estimated to reach NT$ 1.1trillion with YOY 10%, breaking NTD one trillion in consecutive two years, as well as the historical high record.

In terms of revenue, Synnex's IT products and IC components performed the strongest in 2017. Overall annual revenue for IT products surpassed NT$200 billion for the first time, 6% annual growth — hitting a record high for two consecutive years. Revenue for IC components grew at a breakneck 12% to exceed NT$100 billion for the first time. In addition to hitting a new high, this performance also marked 12 consecutive years of growth in the sector.

The company's outstanding performance in IT product revenue is mainly attributable to the sales success of commercial business as well as NB, storage devices and graphics cards. In the commercial sector, Synnex's active establishment of data center solutions in recent years is gradually maturing along with cloud and related commercial services. Simultaneously, governments and businesses are also increasing investment in IT equipment, with 11% revenue growth posted in this area. NB sales rose 12%, spurred by the continuing trend of enterprise and SMB replacement demand, the increasing prevalence of ultra-slim models and strong sales of e-Sports NB. Storage demand for Cloud and surveillance-related purposes also increased substantially, while the eSports and cryptocurrency mining crazes fueled steady shipments of high-end graphics cards; annual growth for both of these segments surpassed 20%.

Regarding IC components, in addition to continuing to increase its market share in the traditional IT industry, Synnex also aggressively expand solution sell into new domains in 2017. This success — which included breaking into the supply chains of AI, IoT, cloud data centers, smart speakers/surveillance/automobile, drones and similar driverless systems, and other emerging industries — saw its IC component revenue grow 12% year on year. As well as surpassing the NT$100 billion threshold in this market, the segment again achieved 12 straight years of growth.

As for consumer electronics and communications, the launch of new iPhones, smart speakers and other devices that may have helped stimulate sales in the second half was dragged down by hesitate attitude toward market in the first six months. Annual revenue decreased by 1% and 6% for the two segments, respectively.

Regionally, Synnex is continuing its efforts to develop commercial channels comprising partners including system integrators, value-added reseller, independent software house and cloud service providers. It has also developed collaborative business models with emerging consumer channels such as e-retailer and large-format chain stores. As well as steadily increasing its market share in its traditional channels, Synnex maintained simultaneous growth across every region in 2017, achieving either all-time-high or five-year record high. In which, China and Hong Kong grew 10% and 15% respectively, and Australia/New Zealand and Indonesia also grew 7% and 8%.

In the year ahead, Synnex will move forward with its efforts to expand into new domains, including data center solutions, cloud services, AI, IoT, smart consumer electronics, third-party logistics and technical services, in order to strengthen the depth and breadth of its channel service. Meanwhile, growth in regional market shares is also on the cards for the company as it eyes continued expansion abroad and continued overall revenue growth. (See attached table for details)