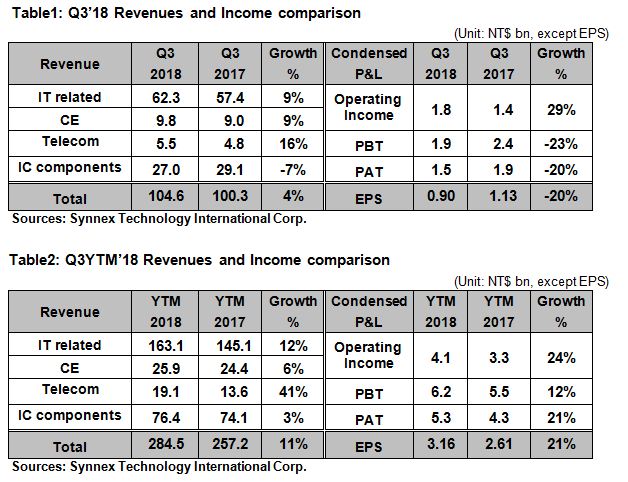

Synnex announced the latest performance for Q3 and YTM of 2018 after the review by CPA. EPS was NT$0.9 for Q3’18 and NT$3.16 for YTM. EPS for full-year of 2018 is expected to reach NT$4, new high record for eight years.

The consolidated revenue for Q3’18 was NT$104.6bn, hitting the consecutive five quarters highest record in the same period, and the second highest record for single quarter with slightly lower than Q4’17. The consolidated revenue for YTM’18 was NT$284.5bn, with a growth of NT$27.0bn or 11% YoY. Revenue for FY’18 is expected to reach NT$400bn. Facing numerous disturbances of trade war, raise in interest and currency depreciation in Asia, Synnex still kept up-trend by increasing market share and aggressive investment.

By geographic prospect, Synnex maintain the growth for revenue in each country. Among them, China and Indonesia performed high growth with 18% to 23%. By product aspect, IT revenue in Q3’18 was not only the record high but also the first time to break NT$60bn. The stunning performance was mainly from high demand in commercial market, including data center, information security and cloud service, and the expansions in eSports field. Synnex is the largest professional eSports distribution channel in Asia with more than 30 internationally famous brands and more than 3000 channels. In the meanwhile, telecommunication and consumer electronics grew 16% and 9% respectively.

For the operating performance, Q3’18 gross margin was 3.8% with 0.4% increase from last year, operating income was NT$1.8bn with a growth of 29% YoY, both reached record high of recent years due to better product mix and increasing proportion in commercial and new field. Q3’18 PAT was NT$1.5, EPS was NT$0.9, with a decline of 20% YoY. If removed NT$0.36bn gains from shares disposal in Lien Hwa Industrial Corp. in Q3’17, PAT remained stable as prior year. YTM’18 PAT was 5.3bn, EPS was NT$3.16, with a high growth of 21%.

Looking forward to Q4’18, although there still would be numerous disturbing factors in the market, Q4’18 revenue performance is still expected to make outstanding record again mainly due to the launch of new eye-catching products, continuous IT investment in enterprise and government digital transformation in the same time, as well as the new channel service model and market operating strategies in new products, new markets, and new channels.