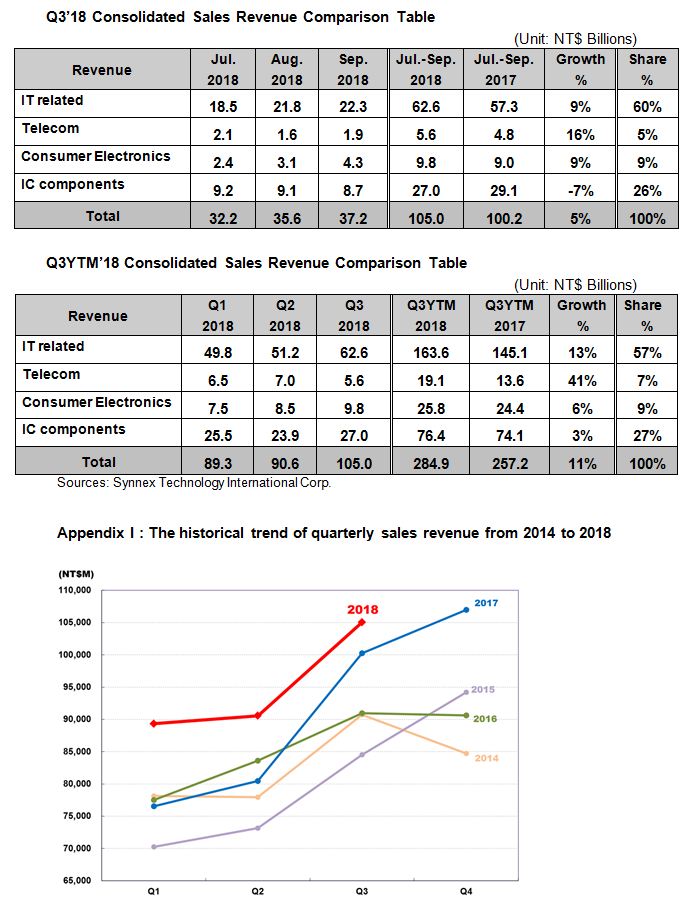

Synnex preliminary consolidated financial results were as follows:

Synnex revenue in Sep.’18 was NT$37.2bn, reaching the second high record in history as well as consecutive 16 months new high record comparing to the same period. Q3’18 revenue was NT$105.0bn, the second high record in single quarter, slightly lower than Q4’17 revenue NT$107bn. YTM revenue was NT$284.9bn, increasing by NT$27.7bn comparing from the same period in last year, with growth of YoY 11%. Synnex 2018 whole year sales revenue is expected to challenge NT$400bn level.

Although the market interfered by numerous factor including trade war, raise in interest rate, currency depreciation in Asia, Synnex still continuously increased market shares due to the aggressive investment in new business field and fully grasped the trend of the bigger the stronger in market. All the subsidiaries in Synnex group performed stably in Q3’18. Among them, China and Indonesia in spite of the trade war and currency depreciation factors, still showed significant growth of 18% and 23% respectively.

By products aspect, Q3’18 IT related sales revenue broke NT$60bn level for the first time, reaching to NT$62.6bn, breaking the historical high level. The growth was mainly from increasing demand in commercial market including data center, internet security and cloud service, as well as the fruitful result from eSports business field, franchising for more than 30 notable local and global brands. Telecom and Consumer products sales revenue also grew with YoY16% and YoY 9% respectively.

Looking forward to Q4’18, although there still would be numerous disturbing factors in the market, Q4’18 revenue performance is still expected to make outstanding record again mainly due to the launch of new eye-catching products, continuous IT investment in enterprise and government digital transformation in the same time, as well as the new channel service model and market operating strategies in new products, new markets, and new channels.