<Electronics stocks News>

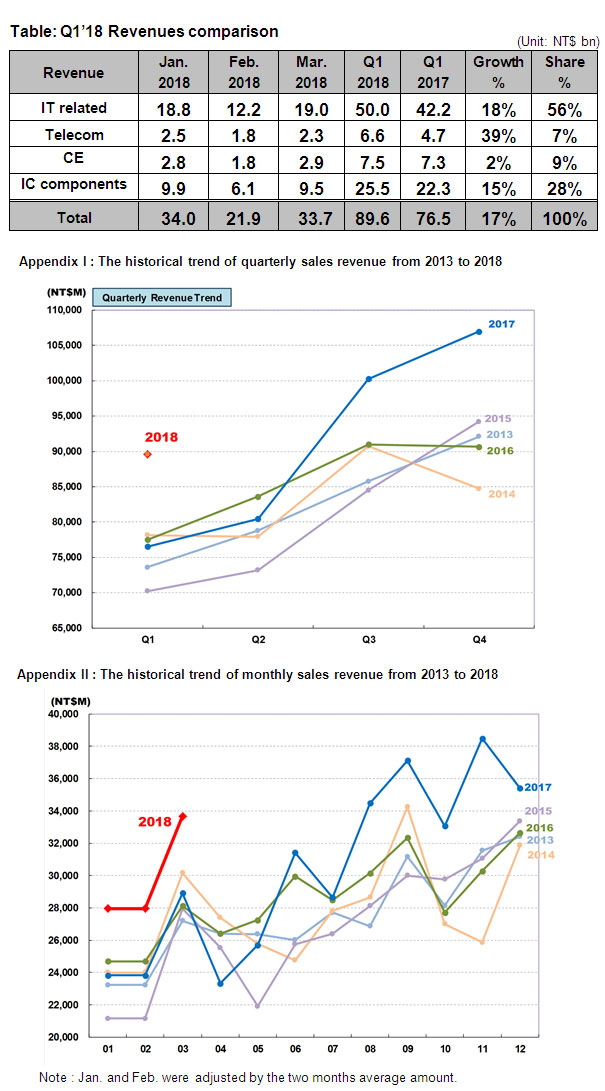

Synnex preliminary consolidated revenue in March was NT$33.7bn, and Q1’18 was NT$89.6bn, with significant growth of 17%, breaking the NT$80bn level and approaching NT$90bn, also hitting the highest record in the same period.

Due to the raising market share in Asia Pacific region and the aggressive buying lasted from last Q3, the demand from consumer, commercial, telecom and IC component markets still remained high, bringing the outperformance in low season. Synnex subsidiaries all grew above two digits. Among them, China, Australia, New Zealand, Taiwan grew with 16%~18% YOY, and Indonesia, Hong Kong grew 31% and 22% respectively.

From product perspective, the revenue from all types of product grew in Q1’18, and telecom even significantly grew with 39%YOY. For IT related product, the main growth was from the commercial product, due to the government and enterprise digital transformation, enlarging the investment in IT equipment, bringing the growth of 21%YOY. For consumer product, revenue grew with 18% YOY, resulting from the hot trend of eSports NB and increase of Ultra-slim. For PC component, due to demand from storage as well as eSports and Bitcoin mining, the growth came to 22%YOY. For Telecom product, the growth was mainly from the launch of new model of Samsung and iPhone, bringing the growth reached to 39%YOY. For IC component, Synnex continuously expand the new product lines including AI, IoT, and new customers, resulting in growth of 15%YOY.

Looking forward to Q2’18, due to the expansion in new products, markets, and channels in recent years led the operation into new growing cycle, Synnex expects the revenue performance still could be better than market with the strong growth momentum to continue from last Q3.