<Electronics stocks News>

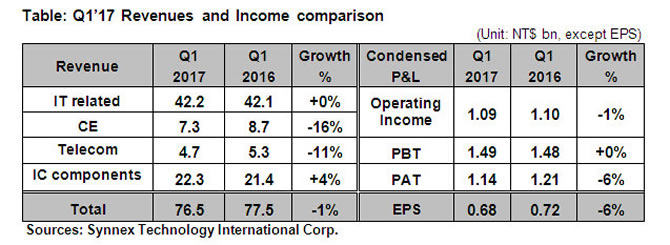

The performance for Q1’17 after the review by CPA: Consolidated revenue was NT$76.5bn, slightly lower than NT$77.5bn in the prior year. Operating income was NT$1.09bn, showed 1% YOY decline from NT$1.10bn in the prior year. PBT was NT$1.49bn, PAT was NT$1.14bn and after-tax EPS was NT$0.68.

Generally speaking, the overall market was facing tremendous challenges in Q1’17. From the aspect of industry demand and supply, the low demand from the Chinese new year vacation, the deferred demand from the expectation for the launch of new cell phone model in the period from Q2 to Q4’17, continuous short supply of panel, NAND, RAM, and the wait-and-see attitude toward market demand due to politic and economic environment chaos, as well as the appreciation of TWD in Y17Q1, all caused the difficulty in operation. While Synnex overall performance was quite stable, and the IT related and IC component sales revenue both broke the historical high record over the same period mainly from the aggressive expansion in the commercial field, the increase in market share, and exploration in new market and clients.

For the business operating, the sales revenue of Y17Q1 amounted to NT$76.5bn, with a decline of 1% from the prior year. If excluding the foreign exchange effect, the growth would come to 3.5%. For the IT related, the continuous expansion in market share of consumer PC and DIY component led growth of 1% and 5% YOY respectively. Commercial product included commercial system, Data Center solution, commercial software and Cloud Service all grew stably. For the IC component, even facing the serious short supply of panel, NAND、RAM, still grew 4% due to the priority supply from the principle and aggressive development in IOT product and client. Mobile phone and tablet declined 11% and 22% respectively causing from the expectant attitude from market before the new product launch and lack of new application and demand from new product.

In terms of profit, due to the increased percentage of commercial product, the gross profit ratio in Y17Q1 reached to 3.90% which was the highest record in recent five years. Operating income came to NT$1.09bn slightly lower than last year. As for non-operating income, the investment income from the joint ventures and logistic rental revenue was NT$0.5bn, with an increase of 7.5%YOY than prior year. Due to the appreciation of TWD, the foreign exchange loss amounted to NT$0.14bn for Q1’17, making the PBT amount to NT$1.49bn which was slightly higher than the last year. PAT was NT$1.14bn, and after-tax EPS was NT$0.68.