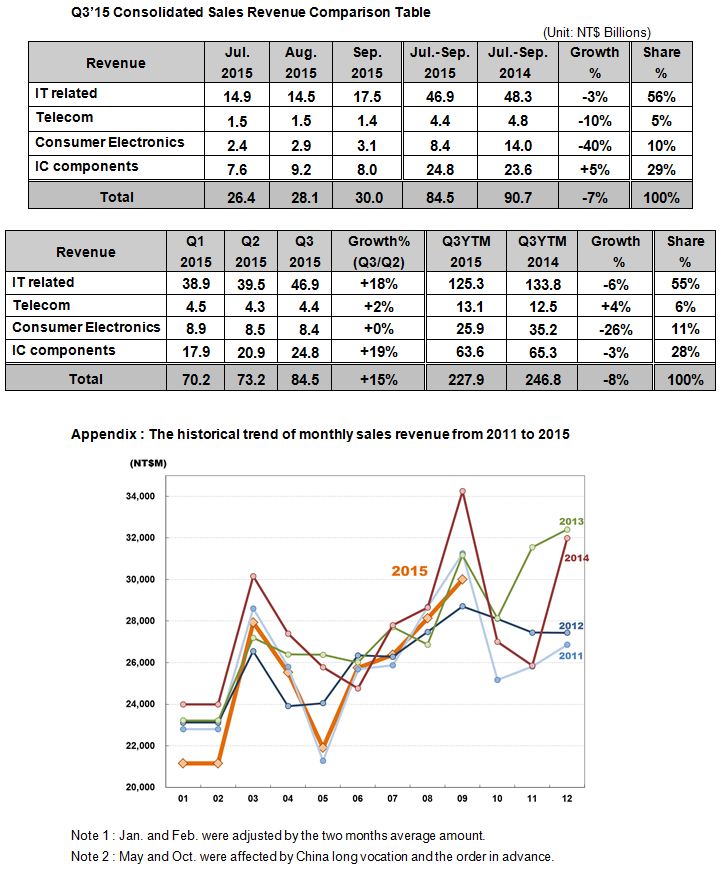

Synnex preliminary consolidated financial results were as follows:

Q3’15 consolidated revenue was NT$84.5bn, with an increase of 15% from NT$73.2bn in Q2’15 and with a decrease of 7% from NT$90.7bn in the prior year. Sep’15 consolidated revenue was NT$30.0bn, showed a 12% YoY decrease from the record high NT$34.3bn, but maintained the level of NT$30bn per month, and also hit the single-month highest this year.

By products breakdown were as follows:

(1). IT sales revenue:

In Sep’15 the sales revenue was NT$17.5bn, showed a 5% decrease from NT$18.4bn in the prior year. In Q3’15 the sales revenue was NT$46.9bn, with a decrease of 3% from NT$48.3bn in the prior year.

(2). Telecom revenue:

In Sep’15 the sales revenue was NT$1.4bn, showed a decrease 17% from NT$1.7bn in the prior year. In Q3’15 the sales revenue was NT$4.4bn, with a decrease of 10% from NT$4.8bn in the prior year.

(3). Consumer Electronics revenue:

In Sep’15 the sales revenue was NT$3.1bn, showed a decrease 52% from NT$6.5bn in the prior year. In Q3’15 the sales revenue was NT$8.4bn, with a decrease of 40% from NT$14bn in the prior year.

(4). IC components revenue:

In Sep’15 the sales revenue was NT$8.0bn, showed a 4% growth over NT$7.7bn in the prior year. In Q3’15 the sales revenue was NT$24.8bn, with an increase of 5% from NT$23.6bn in the prior year, and hit the single-quarter highest in history.

overall performance for Q3’15 maintained the traditional high season level in the market demand. Due to the lack of the new product, consumers waiting for new Apple product launched, and the impact of currencies depreciation, the sales revenue in Q3’15 grew 15% of QoQ, but still declined comparing to the record high in Q3’14.

From a regional perspective, all regions showed a growth trend except China. Taiwan and Hong Kong kept stable. Australia, New Zealand and Indonesia continuously expanded in market share, and still were the main growing area. By the product segment, the main decline in tablet and game products. The tablet market continued being weak. The demand in the game market decreased obviously due to the Xbox One had launched for a while. Besides, the Xbox One launched in Hong Kong, Taiwan and China, as well as the new game product onto the market in Australia in Q3’14 which made the comparison much higher and the larger margin in decline. IT products and IC components market became growing stably. And the telecom market, due to the slow growth momentum in Chia economic, lower ASP, and the deferred demand in Apple iPhone made the decrease in revenue.

Look forward to Q4’15, the official release of Apple iPhone, the expected launch of new generation tablet by Microsoft and Apple as well as the new Skylake PC notebook by numerous PC brands, the Q4’15 revenue would continue to maintain the level in Q3’15.