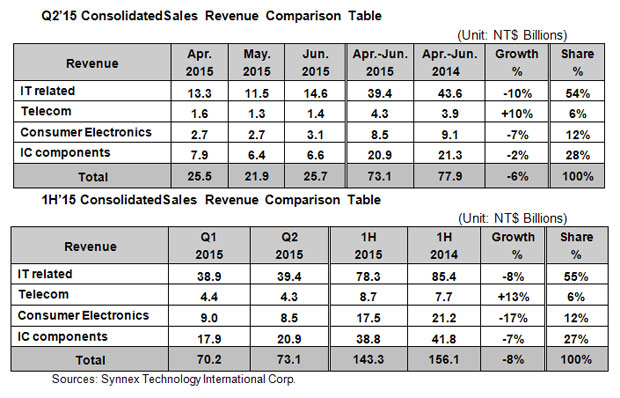

Synnex preliminary consolidated financial results were as follows:

Synnex consolidated sales revenue in Jun’15 was NT$25.7bn, with an increase of 4% YOY from NT$24.8bn in the prior year. In Q2’15, consolidated revenue was NT$73.1bn, with a decrease of 6% YOY from NT$77.9bn in the prior year. 1H’15 YTM sales revenue was NT$143.3bn, with a decrease of 8% YOY from NT$156.1bn in the prior year.

By products breakdown were as follows:

(1). IT sales revenue:

In Q2’15 the sales revenue totaled NT$39.4bn, shared 54% of total consolidated sales revenue with a decrease of 10% YOY. 1H’15 YTM sales revenue amounted to NT$78.3bn, shared 55% of total consolidated sales revenue with a decrease of 8% YOY.

(2). Telecom revenue:

In Q2’15 the sales revenue totaled NT$4.3bn, shared 6% of total consolidated sales revenue with an increase of 10% YOY. 1H’15 YTM sales revenue amounted to NT$8.7bn, shared 6% of total consolidated sales revenue with an increase of 13% YOY.

(3). Consumer Electronics revenue:

In Q2’15 the sales revenue totaled NT$8.5bn, shared 12% of total consolidated sales revenue with a decrease of 7% YOY. 1H’15 YTM sales revenue amounted to NT$17.5bn, shared 12% of total consolidated sales revenue with a decrease of 17% YOY.

(4). IC components revenue:

In Q2’15 the sales revenue totaled NT$20.9bn, shared 28% of total consolidated sales revenue with a decrease of 2% YOY. 1H’15 YTM sales revenue amounted to NT$38.8bn, shared 27% of total consolidated sales revenue with a decrease of 7% YOY.

By the geographic segment, Australia, New Zealand and Indonesia are still the main source of growth. Each the annual growth is over 15% by local currency. Taiwan and Hong Kong maintain a steady pace in the market. China is a marked decline because overall market demand in the doldrums, the competitive situation is grim, operational risks increase. So Synnex policy will focus on quality improvement in business, the pursuit of profit growth is top priority rather than revenue growth.

By the product segment, the sales of mobile phone grow substantially. Relatively, the sales of notebook, tablet and gaming products decline much more. The remaining products broadly are in line with seasonal fluctuations. By mobile phone segment, Synnex sales of nearly 1.3 million Smartphone in quantities in the first half, growing nearly 40% over the same period. It’s mainly due to Apple iPhone 6 and ASUS ZenFone robust demand. The market of notebook is still weak and in the doldrums from the effect of waiting for the launch of Windows 10 in the third quarter. By tablet segment, the sales declined significantly except Microsoft Surface and Apple iPad. By gaming segment, the market is significant cooling due to it’s almost the two years since the launch of Xbox; but expected to sales boom in the second half when the launch of new games and the planning of new type.

Outlook to the third quarter, expected to the significant growth in sales compared with the second quarter in virtue of Windows 10 will be launched on 7/29 this year, new tablet/phones are published by the famous brands, coupled with the effect of traditional peak season.