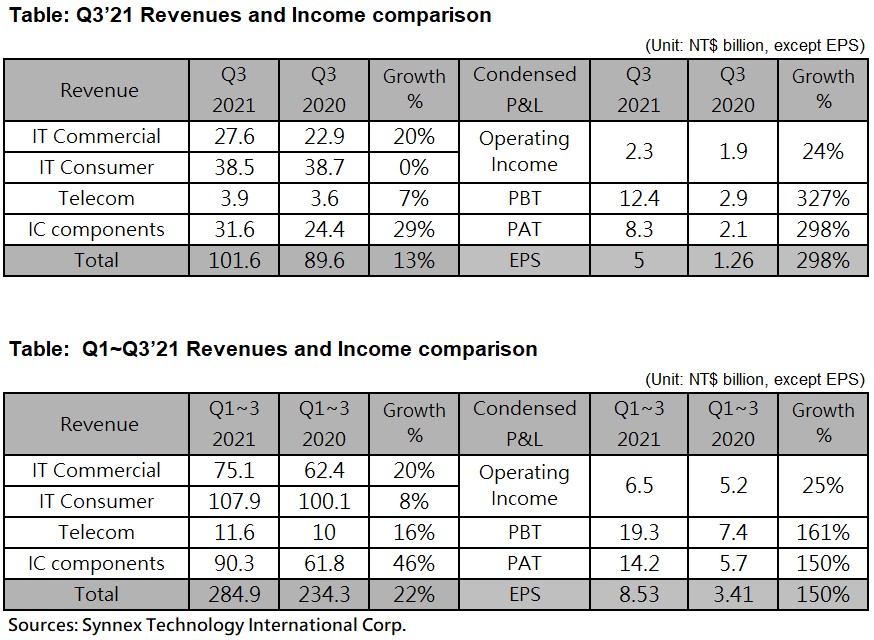

Synnex (2347) announced Q3'21 financial results, revenue was NT$101.6 billion, the second highest in the same period; after-tax net profit was NT$8.3 billion, and earnings per share were NT$5.00. In the first three quarters, revenue was NT$284.9 billion, a record high for the same period; after-tax net profit was NT$14.2 billion, and earnings per share were NT$8.53.

Benefited from the optimization of the product portfolio, Synnex's gross margin in the third quarter was 4.3%, a record high for the same period; and gross profit was NT$4.4 billion, a record high in a single quarter, with an annual increase of 15%. Synnex said that since this year Synnex has accelerated the building of the "Management Service Platform (MSP)" to provide the entire supply chain with the most appropriate business model. At the same time, it has widely used APP to speed up the response to market dynamic and customer needs. Not only has it greatly strengthened the adhesion of the existing supply chain, it has also been recognized by international manufacturers such as Fitbit, JBL, Canon, and Nikon, and actively expanded business engagement with Synnex.

In terms of operating income, Synnex has undergone the Agility Project in recent years, and its operations have become more refined, its profitability has been greatly progressed. Synnex not only regularly cleans up unprofitable product lines, but also continues to improve operating procedures, accurately control expenses, and comprehensively improve operational efficiency through digital optimization, information concatenation, and AI big data analysis. Synnex's third-quarter operating income margin was 2.3%, a record high for the same period, and its operating income was NT$2.3 billion, a record high in a single quarter, with a sharp increase of 24%.

In addition, Synnex's oversea joint ventures in US/Japan, India/MEA, Thailand and Vietnam have also achieved outstanding performance, the JV income was NT$ 850 million in the third quarter, a record high for the same period for five consecutive quarters, with 47% growth. Among them, Vietnam increased significantly by 70% annually, India/MEA and US/Japan also increased by 62% and 45% respectively.

In the third quarter, Synnex generated a nonrecurring profit due to the loss on influence and the change from the equity method to fair value method in SYNNEX Corp. (US), resulting in before-tax and after-tax net profits of NT$12.4 billion and NT$8.3 billion , and earnings per share were NT$5.00. Excluding this nonrecurring profit, the before-tax and after-tax net profits will be NT$3.4 billion and NT$2.9 billion respectively, and earnings per share will be NT$1.77, which is still the second highest record of a single quarter.

Looking forward to the fourth quarter, Synnex recently announced that October revenue continued to stand above NT$30 billion, reaching NT$33.6 billion with an annual increase of 18%. Synnex said, the fourth quarter is originally a traditional peak season, and the strong buying in the consumer market will continue until the end of the year. The enterprise and government procurement budgets delayed by the epidemic will also be implemented at an accelerated pace before the end of the year. Coupled with the upgrades and replacement demand driven by the launch of new products, Synnex is optimistic that sales momentum will remain strong, and it is expected to hit another high in the fourth quarter and whole year.