Synnex preliminary consolidated financial results were as follows:

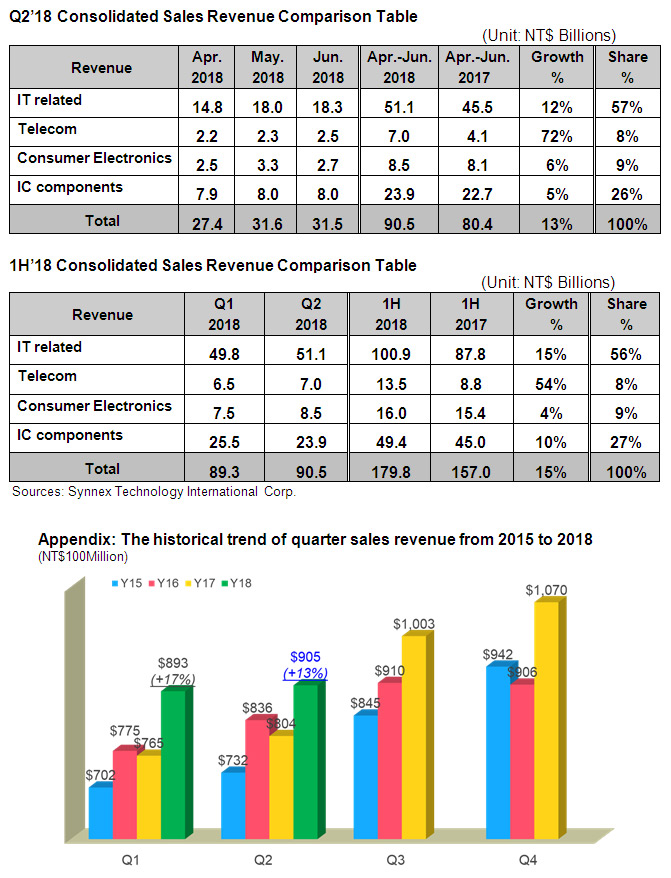

Synnex profit was soaring again! Synnex consolidated sales revenue in 1H’18 was NT$90.5bn, with growth of 13%YoY, hitting the consecutive four quarters highest record in the same period, as well as the first time of breaking NT$90bn in the first half of year in history. 1H’18 revenue was NT$179.8bn, with significant growth of 15%, also reaching the new high record in the same period.

By geographic prospect, Synnex maintains the growth momentum form Q1’18 with double-digit growth. Among them, China grew 16%, Taiwan grew 19%, Australia, New Zealand, Indonesia and Hong Kong as well as grew from 10% to 12% YoY.

By products aspect, IT related sales revenue in Q2’18 grew 12%YoY mainly from the commercial products due to continuous digital transformation from enterprises and government, enlarging the investment in IT equipment, as well as bringing the demand from server, internet security and cloud service/software to significant growth of 23%YoY. Furthermore, the hot trend from eSports spurred the tremendous growth of related component and high level, large size monitor. Consumer Electronics products grew 6%YoY due to the tablet demand and gradually mature market of drone, VR, smart wearable. Mobile phone market gradually changed from operator subscription contract to unlock phone, sales revenue growth reaching 72%YoY. Although Synnex developed in AI and IoT new fields had already taken effect, TV panel demand weakened with lower price, led to moderate growth of 5% YoY in IC component revenue.

Looking forward to 2H’18, although there are enormous uncertainty factors in the market, Synnex will follow new channel service model and market operating strategies of multi-products, multi-channels, and multi-markets. Through these strategies, Synnex sustain the robust growing performance. In the meantime, Synnex believe the new development of new products, new markets, and new channels have leaded the company into new growing cycle and consecutively expanding market shares. 2H’18 revenue performance is still expected to have a substantial growth compared with the 1H’18 revenue.