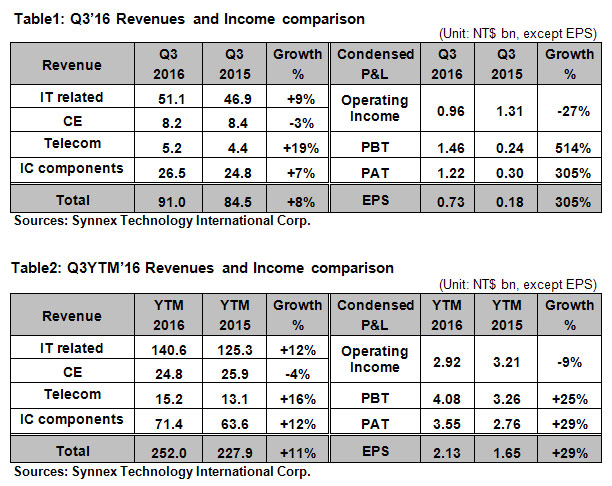

Synnex has announced its Q3’16 reviewed consolidated results as follows:

Q3’16 consolidated revenue was NT$91.0bn with increase of YOY 8%, and hit the highest record over the same period. PAT was NT$1.22bn, with growth of YOY 305% and EPS was NT$0.73. Q3YTM’16 consolidated revenue was NT$252.0bn with growth of YOY 11%, breaking the historical high record. Q3YTM’16 PAT was NT$3.55bn with increase of YOY 29% and EPS was NT$2.13.

Synnex achieved stunning revenue performance in Q3’16 continuing the remarkable performance from the last two quarters. Q3’16 revenue grew with YOY 8%, breaking the highest record over the same period. Q3YTM’16 consolidated revenue came to YOY 11%, hitting the historical new record. By geographic segment, not only the consistent growth in Indonesia, but also China kept growing for consecutive four quarters since Q4’15 after the launch for new operating strategy and structure in 2015. Moreover, the market shares in Taiwan expanded over 30% YOY for continuous two quarters.

By the product segment, the IT product and IC component made brisk performance, and both set the highest record in Q3’16. The strong growth in IT related product was from the expansion of the product line of commercial market, the development of channel, and the synergy from the cloud business, leading the YOY growth to 21%. Furthermore, the Retail system revenue grew 18% YOY mainly from the grasp of the trend in the gaming PC and NB market and the demand from VR, as well as expansion in the market share of middle and high level product. Telecom revenue grew with 19%YOY benefited from the launch of iPhone 7 in September, bringing the growth in sales. IC component revenue increased with 7% YOY due to the expansion of the Internet of Things (IoT) product line, the innovative supply chain service model, software design, and the solution improvement would also be the critical factor of the strong growth.

For the operating performance, Q3’16 PAT was NT$1.22bn, with a significant growth of YOY 305% and EPS was NT$0.73. The investment income increased substantially due to the remarkable performance of the core joint venture business in US, Thailand, India and Middle East. Synnex US aggressively developed the commercial outsourcing service business in recent years, not only improving the revenue performance, but also the profit, and the Q3’16 investment income grew with 9% YOY. The market in Thailand had back to the growth track, increasing the revenue and profit simultaneously, and the investment income grew with 12% YOY. The markets in India and Middle East remained the stable growth, and due to the continuous expansion in market shares of Redington, causing the wide gap from the competitors and the investment income grew with 17% YOY. Q3YTM’16 PAT was NT$3.55bn, with growth of 29%YOY, and EPS was NT$2.13.