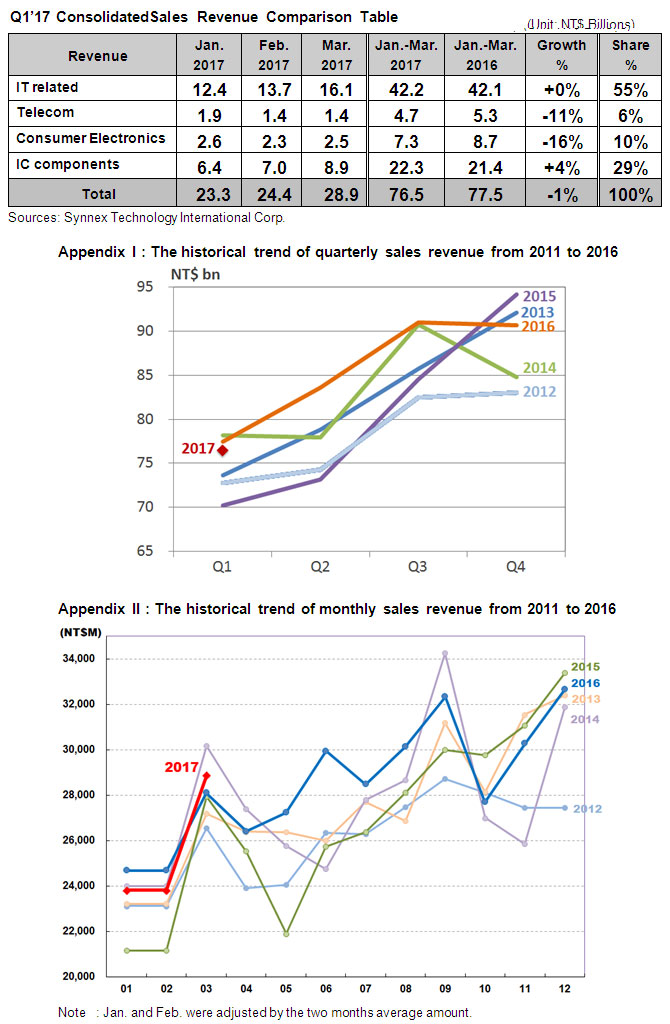

Synnex preliminary consolidated financial results were as follows:

Synnex consolidated sales revenue in Mar’17 was NT$28.9bn, and Q1’17 sales revenue accumulated to NT$76.5bn slightly lower than last year.

By products breakdown were as follows:

(1). IT sales revenue in Mar’17 was NT$16.1bn. Q1’17 sales revenue was NT$42.2bn, with slightly increase from the prior year and shared 55% of total consolidated sales revenue.

(2). Telecom sales revenue in Mar’17 was NT$1.4bn. Q1’17 sales revenue accumulated to NT$4.7bn, with a decline of 11% YOY and shared 6% of total consolidated sales revenue.

(3). Consumer Electronics sales revenue in Mar’17 was NT$2.5bn. Q1’17 sales revenue accumulated to NT$7.3bn, with a decrease of 16% YOY and shared 10% of total consolidated sales revenue.

(4). IC components revenue in Mar’17 was NT$8.9bn. Q1’17 sales revenue accumulated to NT$22.3bn, with an increase of 4% YOY and shared 29% of total consolidated sales revenue.

Overall speaking, the market condition in Q1’17 did not perform well, including the low demand from the Chinese new year vacation, the delay demand from the expectation for the launch of new cell phone model in the period from Q2 to Q4’17, continuous short supply of panel, NAND, RAM, and the wait-and-see attitude toward market demand due to politic and economic environment chaos, all caused the difficulty in operation. While Synnex overall performance was quite stable, and the IT related and IC component sales revenue both broke the historical high record over the same period mainly from the aggressive expansion in the commercial field, the increase in market share, and exploration in new market and clients.

For the IT related, the continuous expansion in market share of consumer PC and DIY component led growth of 1% and 5% YOY respectively. Commercial product included commercial system, Data Center solution, commercial software and Cloud Service all grew stably. For the IC component, even facing the serious short supply of panel, NAND、RAM, still grew 4% due to the priority supply from the principle and aggressive development in IOT product and client. Mobile phone and tablet declined 11% and 22% respectively causing from the expectant attitude from market before the new product launch and lack of new application and demand from new product.

Looking forward to the sales performance in Q2’17, due to the demand had come back in March, and also the launch of new IT related and telecom product will start from Q2’17, adding the contribution from the new field, new product, and new customer. Synnex could enjoy the high performance in Q2’17.