Synnex preliminary consolidated financial results were as follows:

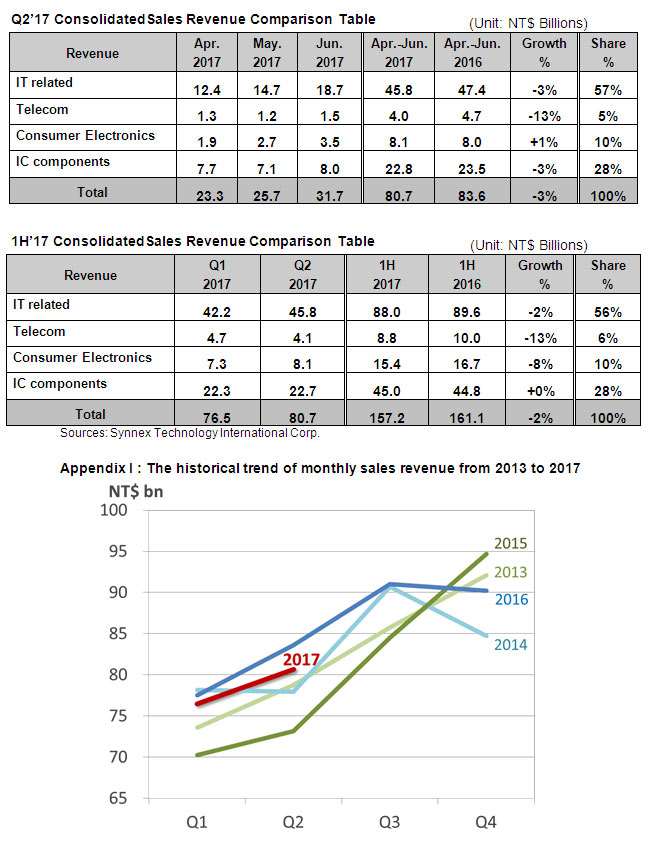

Synnex consolidated sales revenue in Jun’17 was NT$31.7bn, with an increase of 6% from NT$30.0bn in the prior year, hit the historical new high over the same period, also broke the single month record of over NT$30bn in 1H’17. In Q2’17, consolidated revenue was NT$80.7bn, and 1H’17 consolidated revenue was NT$157.2bn which was slightly lower than the same period in the last year due to the appreciation in TWD.

Overall speaking, the market situation of the first-half for 2017 was still under expected. Specifically during Jan/Feb for Chinese New Year, the buying power was below expectation. Though the demand in Mar. had seen slightly rebounded but demand slowed down in April. The market started to stabilize until May, and rebounded in a great deal in June. The fluctuations in 1H’17 was mainly due to consumers were relatively hesitated to purchase in anticipating for the new product roll-out in the rest of the year; as for the commercial market, the new corporate investment was impacted by the overall uncertainties posed by economic and political perceptions. Total performance of Synnex has been relatively stable, as strategic actions have been put forward to focus on the commercial use market by continuously developing new market as well as new customer and yet to increase the market share at the consumer market. In which IT and IC component sectors had seen in a growth path and the 2Q’17 IT and IC component revenue both hit the second historical high record.

By the geographic segment, the Q2’17 consolidated revenue in TWD was slightly lower than the same period in the last year due to the appreciation in TWD. If conversion into original currency, all the revenue in China, Hong Kong, Australia, New Zealand, Bestcom were higher than the prior year. Furthermore, the revenue in China and Hong Kong grew 13% and 10%YOY respectively, and Bestcom also hit the historical high record over the same period.

By the product aspect, IT sales revenue in Q2’17 was NT$45.8bn, reached the second high record in the history. Among the IT products, consumer PC and commercial product both remained the high level comparing to last year. The expansion in market share of DIY component and advance graphic card led to growth 5% YOY, and broke the highest record over the same period. For the IC component, though severe shortages on panel, NAND,RAM etc. in the supply chain, Synnex has strived to gain the priority and preferred allocation and efforts in developing products and customers in IOT product and customers, the revenue reached to NT$22.7bn, with a slight decline comparing to the prior year. For the Consumer Electronics, the tablet market gradually became stable, and Synnex aggressively introduced the smart Home, drones, and wearable devices, in result of the bounce back in revenue, with an increase of 1% YOY. Telecom revenue dropped 13% YOY due to the hesitant attitude toward the telecom market.

Looking forward to 2H’17, new products will successively launch, including Apple, iPhone, Samsung Note 8, Microsoft Surface Laptop, New version Surface Pro and xBox One X True 4K Game Console, adding the Data Center solution, cloud service, IOT, smart consumer electric product, and the third party logistic service, all the new area new products and services will continue to contribute the profit. Synnex is looking forward to enjoying the outstanding revenue for the next half year of 2017.