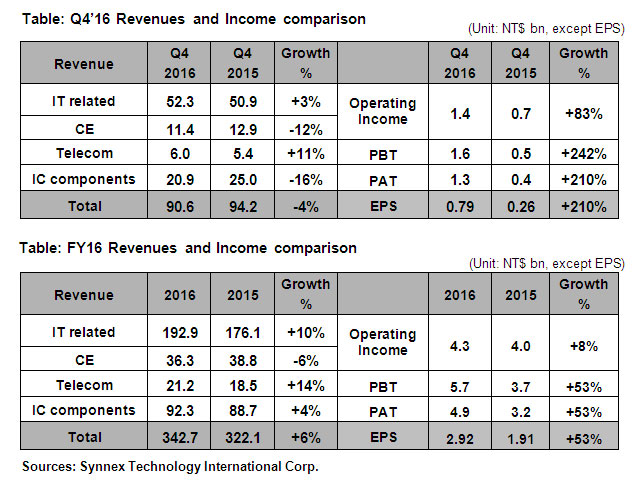

The performance for 2016 Q4 after the audit by CPA, consolidated revenues for Q4’16 was NT$90.6bn, and operating income was NT$1.35bn, with an increase of 83% YOY. PAT was NT$1.33bn, with a significant growth of 210% YoY. The after-tax EPS for Q4’16 was NT$0.79. The total consolidated revenue of FY16 was NT$342.7bn. Operating income was NT$4.27bn, with an increase of 8% YOY. The PAT was at NT$4.88bn, with growth of 53%YOY. The annual after-tax EPS was NT$2.92.

Whether the consolidated revenue or joint venture business both performed well in 2016. The FY16 consolidated revenue was NT$324.7bn, breaking the highest record in history. Adding the performance form joint venture business, the global revenue broke NT$1trillion, and also hit the historical high record.

For the business operating performance, including PC, DIY components, commercial products and IC components business all broke the historical high record. As for PC, the growth of NB and PC came to 18% in spite of the decline market demand. For the DIY components, due to the continuous expansion in market share, the demand for middle and high level VGA, MB and CPU increased, leading to the raise in ASP. The commercial revenue including commercial system, Data Center Solution and commercial software broke NT$66bn, with growth of 16%YOY. For the cloud service, the revenue from “Cloud Business Automatic Platform” continued to grow rapidly, and came to NT$0.2bn. The tablet and Xbox declined with 11% and 17% YOY respectively causing from the low market demand and the shift to mobile gaming.

For the joint venture business, the markets in US, India/Middle East and Thailand performed remarkable revenue and profit with strong growth in 2016. For the sales revenue, all the joint venture business broke the highest new record in Y16, and came to growth of 10%. For the investment income, total investment income under the equity method grew with 9% YoY.

Look back to 2016, improvement in operating mechanism and well risk management control led to the performance better than 2015 and the decrease in operating expense ratio. Operating income was NT$4.3bn, with growth of 8%YOY. PAT was NT$4.9bn, with an increase of 53%YOY. After-tax EPS was NT$2.92. Look forward to 2017, expecting to maintain the growth in revenue and the continuous effect from management, Synnex could enjoy the high profit in 2017.

In addition, BOD resolved and declared 2016 dividend distribution of cash dividend of NT$1.0 per share.