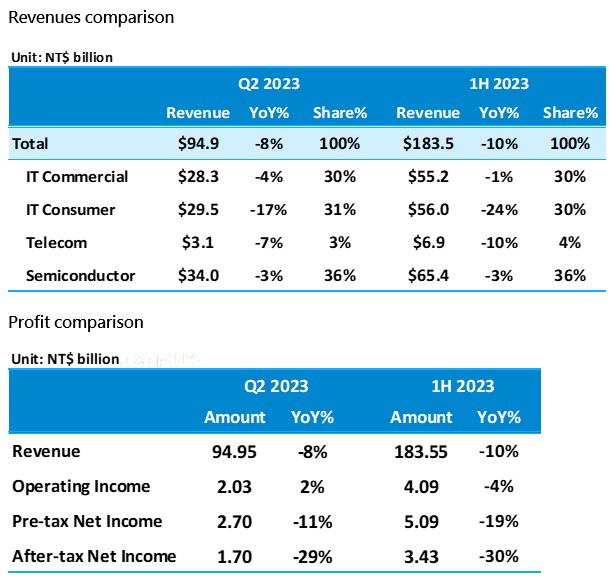

Impacted by prolonged softness in market demand for laptops and mobile phones, Synnex (2347)'s second-quarter revenue reached NT$94.9 billion, reflecting an 8% decline compared to the corresponding period last year, yet exhibiting a 7% increase from the first quarter. Operating income buoyed by robust gross profit and effective cost control, culminating the second-highest level for the same period and showcasing a 2% annual upturn. The after-tax net profit experienced a 29% annual decrease to NT$1.70 billion, resulting in earnings per share of NT$1.02. This decline was attributed to escalated interest expenses due to interest rate hikes, coupled with the discontinuation of recognizing joint venture income of US.

During the second quarter, market demand remained weak across various product categories including notebooks/desktops, storage devices, computer components, and peripherals/consumables, all of which hit a five-year nadir. Conversely, products oriented towards enhancing productivity and AI applications such as servers, storage systems, and cloud and AI services like Azure/Copilot achieved an annual growth rate surpassing 20% to 30%, setting continuous new records for the same period. Complemented by successful acquisitions of new customers in the smart device and semiconductor sectors, Synnex's revenue escalated progressively through the second quarter. June, in particular, witnessed a near 30% monthly growth rate, contributing to an overall cumulative increase of 7% for the quarter.

In terms of profitability, despite the revenue decline, the second quarter saw Synnex's gross profit surge to a record NT$4.18 billion, driven by an augmented proportion of high-margin products like value-added commercial and smart devices. The gross profit margin reached 4.40%, the second highest within the same period comparison. Leveraging elevated gross profit and stringent operating expenses management, operating income also achieved its second-highest level for the same period, culminating in a 2% annual increase, totaling NT$2.03 billion and 2.14%. Pre-tax net profit experienced an 11% YoY decline to NT$2.70 billion due to the elevated interest rate environment and the last year's recognition of US investment income. However, Synnex proactive enhancement of operational efficiency and precise inventory control led to reduced turnover days and working demand, consequently driving a 65% reduction in net interest expenses compared to prior quarter. This contributed to a 12% QoQ increase in pre-tax net profit for the second quarter, teaching 2.84%. After-tax net profit landed at NT$1.70 billion, translating to earnings per share of NT$1.02, a 29% annual decline.

For the first half of the year, Synnex achieved NT$183.5 billion in revenue, NT$4.09 billion in operating income, NT$5.09 billion in pre-tax net profit, NT$3.43 billion in after-tax net profit, and earnings per share of NT$2.06.

Looking forward, Synnex remains optimistic, acknowledging the prevailing market uncertainty, while committing to optimizing its business structure, streamlining operations, bolstering operational efficiency, and promptly adapting to market fluctuations. The performance forecast for the latter half of the year remains aligned with initial expectations, poised for gradual improvement over the course of the season.