Synnex has achieved outstanding performance of 2018. FY18 consolidated revenue reached to NT$383.2bn, breaking historical high record in consecutive three years. PAT came to NT$6.6bn, hitting historical second highest record, and EPS reached NT$3.96. Synnex global revenue including joint venture business broke US$40bn level, achieving US$41.4bn (above NT$1.2 trillion), remaining the global second largest channel service distributor, narrowing down the gap from the largest distributor. Synnex made remarkable performance both for revenue and profit in 2018.

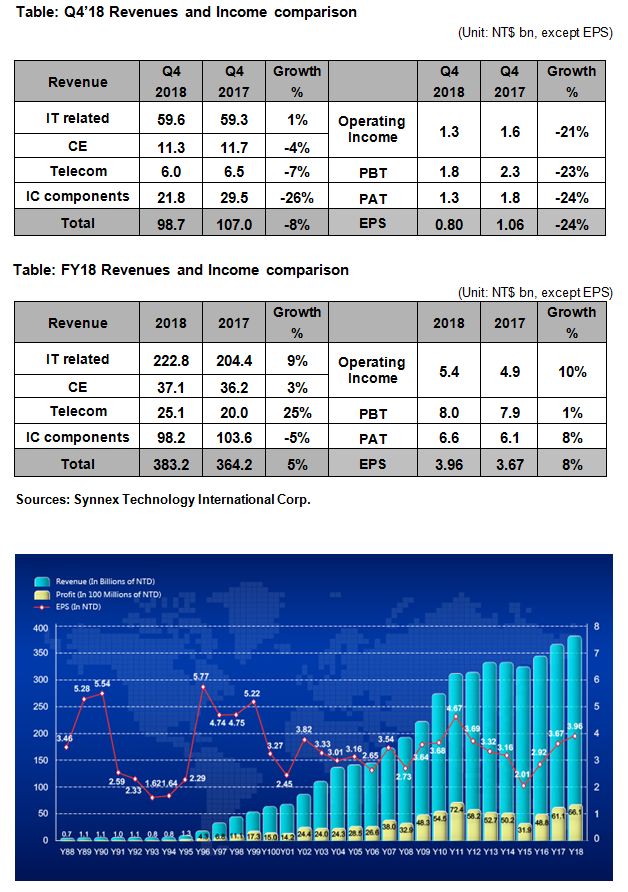

The performance for Q4’18 after the audit by CPA, consolidated revenues for Q4’18 was NT$98.7bn, and EPS was NT$0.8. FY18 revenue came to NT$383.2bn with 5%YoY. Due to increase portfolio portion for high level and commercial products, new business filed expansion and optimization in business operating management, gross margin ratio achieved the high level in past 10 years, operation income totaled to NT$5.4bn, with YoY 10%. PAT reached NT$6.6bn, hitting historical second highest record. After-tax EPS was NT$3.96, with YoY 8%.

FY18 distribution BU revenue achieved NT$285bn, with 9% growth, reaching historical high record in two consecutive years. In recent years, the revenue scale boosted with annual increase of NT$ 10bn, and significantly grew around 20% in 2018, bringing the robust growth engine in distribution BU revenue. Another growth motivation was attributable to the aggressive development in eSports and smart devices new fields in 2018, with double digit growth, nearly contributing 5% of total revenue. As for other core business, for example, retail system, tablet, computer component, smart phone, peripheral and supplies grew 5%~25% respectively, with superior performance than the market due to the expansion in market share.

As for IC component business, FY18 revenue was NT$98.2bn, second highest in history. Synnex kept expanding new industrial application, including industrial control/AIoT, automobile device, smart consumer electronic and internet/communication fields, totaled to half revenue contribution, bringing IC component revenue grew with 10% YOY in the first half year. However, due to the impact of Intel’s CPU shortage and trade war, causing the disturbance in manufacturing schedule, customers became hesitant toward order willing in the second half of 2018. IC component revenue dropped 5% from the highest record in prior year, but still remained the second highest record.

Looking forward to 2019, despite of numerous disturbance factors in the market, still expecting the government will enlarge domestic demand to deal with the slowdown from foreign trade. It will be the positive effect to Synnex, since the majority revenue come from domestic demand market. Furthermore, enterprises will continue to invest in digital transformation and enhancement of internet security. The official launch of 5G could spur the system establishment, equipment update and the demand of replacement. Synnex already stably remain the second largest global channel service distributor, magnet effect is expected in new products, market and channels to bring continuously market share expansion in all countries. Synnex expect to enjoy outstanding performance in 2019 superior than market performance.

In addition, BOD resolved and declared 2018 cash dividend distribution of NT$2.0 per share.