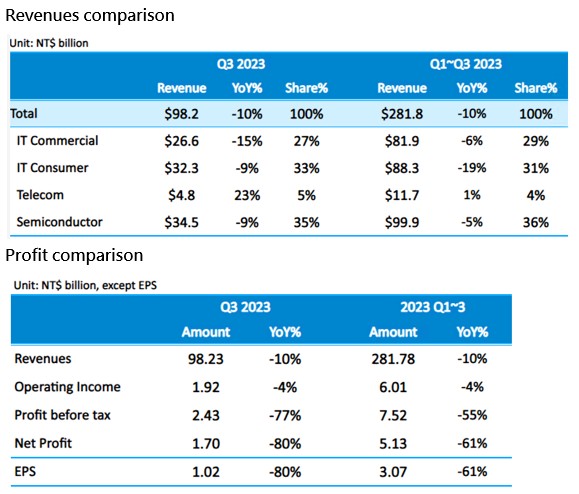

Benefiting from the launch of new mobile phones and a surge in demand during back-to-school season, Synnex(2347)'s revenue for the third quarter reached NT$98.2 billion, a 3% increase compared to the previous quarter. Notably, both gross profit margin and operating income margin outperformed the same period last year. After-tax net profit amounted to NT$1.70 billion, with earnings per share of NT$1.02.

In the third quarter, the terminal consumer market reaped the rewards of new mobile phone launches and the heightened shopping demand during the back-to-school season. This contributed to a slight upturn in overall consumer sentiment. The Telecom business saw a 23% YoY increase, with significant growth in the Indonesian and Australian markets. In the IT Consumer business segment, products such as consumer laptops/desktops, gaming, storage devices, and computer components stabilized in the third quarter, driving a 10% increase in revenue for this segment. However, the IT Commercial business was significantly impacted by a slowdown in market demand, leading to a 15% YoY decline. As for the Semiconductor business, it faced the challenges of conservative customer order patterns, resulting in a mere 1% increase in the third quarter and a 9% decrease compared to the previous year.

Regarding profitability, Synnex's third-quarter gross profit was NT$4.14 billion, and operating income was NT$1.92 billion, slightly lower than the previous year. However, the gross profit margin of 4.22% and the operating income margin of 1.95% both outperformed the same period last year. The business in regions like Thailand, Vietnam, India, the Middle East, and Africa delivered impressive revenue performance, contributing to a substantial 22% increase in profitability for the quarter. Synnex's third-quarter pre-tax net profit was NT$2.43 billion, a 77% YoY decrease, with an after-tax net profit of NT$1.7 billion and earnings per share of NT$1.02. The significant decline in pre-tax net profit compared to the previous year's third quarter can be attributed to the impact of a high-interest rate environment, increased interest expenses, as well as the recognition of U.S. investment income and a non-recurring valuation profit of up to NT$8.1 billion in the previous year's third quarter.

For the cumulative results of the first three quarters, Synnex's revenue reported NT$281.8 billion, with an operating income of NT$6.01 billion, pre-tax net profit of NT$7.52 billion, after-tax net profit of NT$5.13 billion, and earnings per share of NT$3.07.