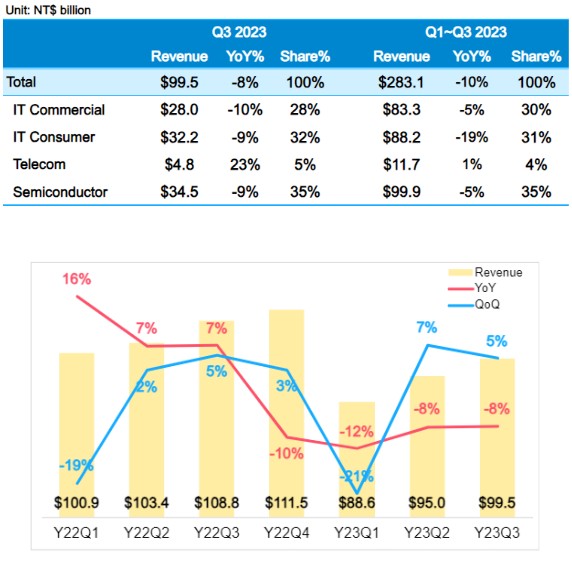

Thanks to the launch of new smartphones and the return-to-school demand in the IT consumer market, Synnex(2347) achieved a third-quarter revenue of NT$99.5 billion, representing a 5% increase compared to the previous quarter. However, due to a slowdown in the commercial market and semiconductor shipment performance falling short of expectations, third-quarter revenue declined by 8% compared to the same period last year.

In the third quarter, the consumer terminal market benefited from the launch of new smartphones and the back-to-school demand, resulting in an overall boost in consumer sentiment. Within this market, the telecom sector experienced a year-on-year increase of 23%, with significant growth of 69% and 37% in the Indonesian and Australian markets, respectively, and an 9% growth in Taiwan. Meanwhile, in the IT Consumer business segment, which includes products such as consumer laptops/desktops, gaming, and storage devices/computer components, there was a noticeable stabilization after experiencing consecutive quarters of double-digit declines over 3 to 5 quarters. This led to a single-digit year-on-year decrease in revenue and a quarterly increase of 9%.

The IT Commercial business segment was significantly affected by a substantial slowdown in demand in both the China and Taiwan markets, resulting in a 10% decline in the third quarter compared to the same period last year. This decline encompassed various product categories, including commercial laptops/desktops, servers, storage systems, networking, and cybersecurity products, all experiencing declines of 10% to 15% or more. In contrast, cloud services and software remained stable. On the other hand, the Semiconductor business faced its own challenges, with an uncertain overall market outlook and conservative customer demand. This led to a lackluster third quarter, with only a marginal 1% increase compared to the second quarter, and a 9% decrease compared to the same period last year.

For the cumulative total of the first three quarters, Synnex reported revenues of NT$283.1 billion, marking a 10% year-on-year decrease. During this period, IT Consumer products experienced a decline of 19%, while IT Commercial and Semiconductor segments both saw slight decreases of 5%. In contrast, the Telecom segment witnessed a 1% year-on-year increase.

Looking ahead to the fourth quarter, Synnex recognizes the unpredictability of market conditions. Nevertheless, the Company remains committed to optimizing its operational efficiency and adapting agilely to market changes. As a result, Synnex anticipates that its fourth-quarter performance will continue the trend of sequential improvement.