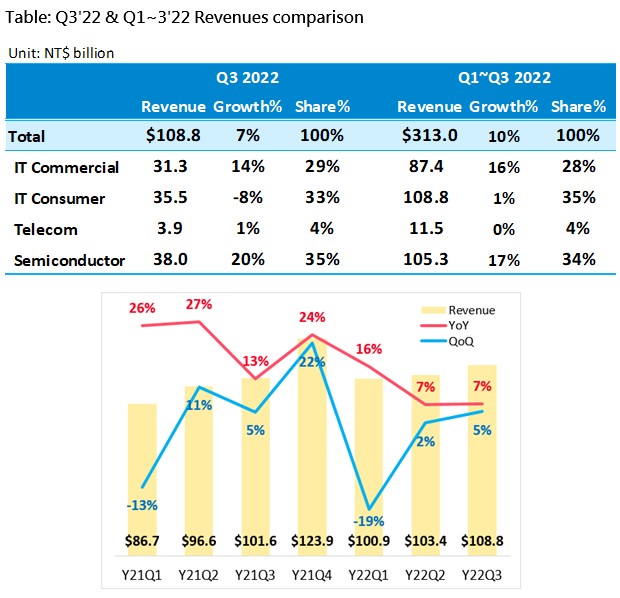

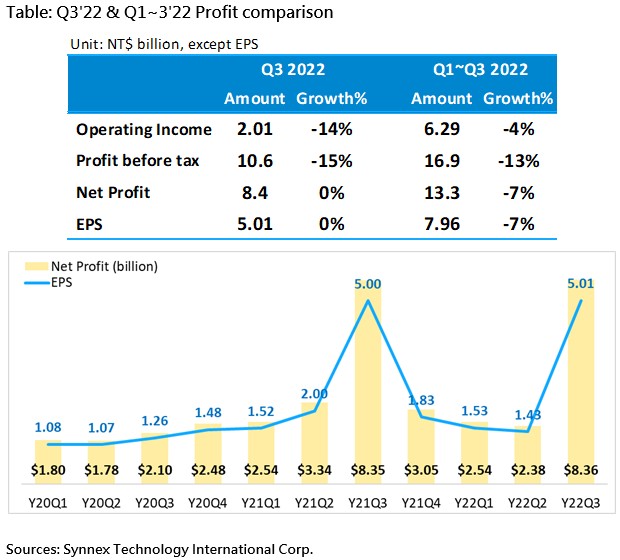

Synnex's (2347) revenue in the third quarter was NT$108.8 billion, a record high for the same period and the second highest in a single quarter, with an annual increase of 7%. After-tax net profit was NT$8.36 billion, and earnings per share were NT$5.01, simultaneously hitting a single-quarter record high. For the first nine months of this year, revenue was NT$313.0 billion, setting a historical record of breaking the 300 billion level for the first time in the first three quarters, and an annual increase of 10%. After-tax net profit was NT$13.28 billion, and earnings per share were NT$7.96.

In the third quarter, the market continued to be affected by inflation, interest rate raised, and changes in political and economic situations. In addition to the lack of consumer confidence, companies were also more cautious about IT spending, which did put pressure on cost control. However, the Management Service Platform that Synnex has been actively developing this year has given full play to the key value of regulating the upstream and downstream of the supply chain, driving the revenue of Synnex to increase quarter by quarter in the first three quarters, and successively set new highs for the same period. In addition, the Agile and Leap Forward projects promoted by Synnex in recent years have also established a strong physique, enabling Synnex to maintain a stable performance in a turbulent environment.

Synnex's third-quarter revenue was NT$108.8 billion, a record high for the fourth consecutive quarter, and surpassed the 100 billion mark for the fifth consecutive quarter. Among them, the IT Commercial business recorded a record high for seven consecutive quarters, with an annual increase of 14%; the Semiconductor business actively developed the Management Service Platform, and new customers continued to join, with a substantial growth of 20%, and set a single-quarter record high for three consecutive quarters. As expected, the IT Consumption and Telecom businesses were affected by inflation and terminal purchases, with a year-on-year decrease of 8% and a slight increase of 1% respectively.

In terms of profitability, Synnex's third-quarter operating income was NT$2.01 billion, a decrease of about 300 million compared with last year, mainly due to the decline in gross profit caused by destocking and inflation that pushed up operating expenses. After-tax net profit was NT$ 8.36 billion, a record high for a single quarter, mainly due to the outstanding performance of overseas joint ventures and the non-recurring profit of the accounting treatment change of Concentrix Corp. Earnings per share in the third quarter were NT$5.01, which was also a record high in a single quarter.

In the first three quarters of this year, revenue was NT$313.0 billion and gross profit was NT$12.74 billion, both hitting record highs with an annual increase of 10% and 2% respectively. Operating income, after-tax net profit and earnings per share reached the second highest in history, at NT$6.29 billion, NT$13.28 billion and NT$7.96 respectively.

Looking forward to the fourth quarter, although the overall economy will continue to be disturbed by various variables, as the government and enterprises have fully sensed the changes in the macro-environment, and have also taken quick actions to respond to the highly volatile market conditions, this wave of market adjustments may end sooner than expected, and Synnex is cautiously optimistic about future opportunities.