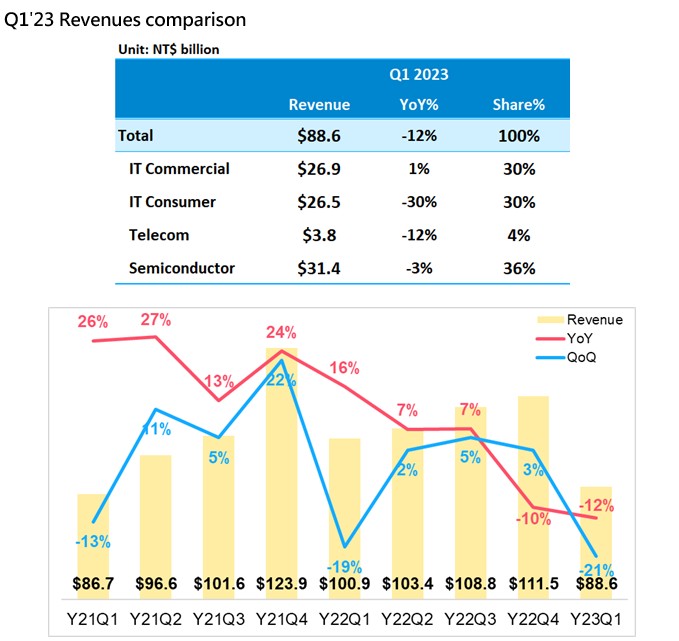

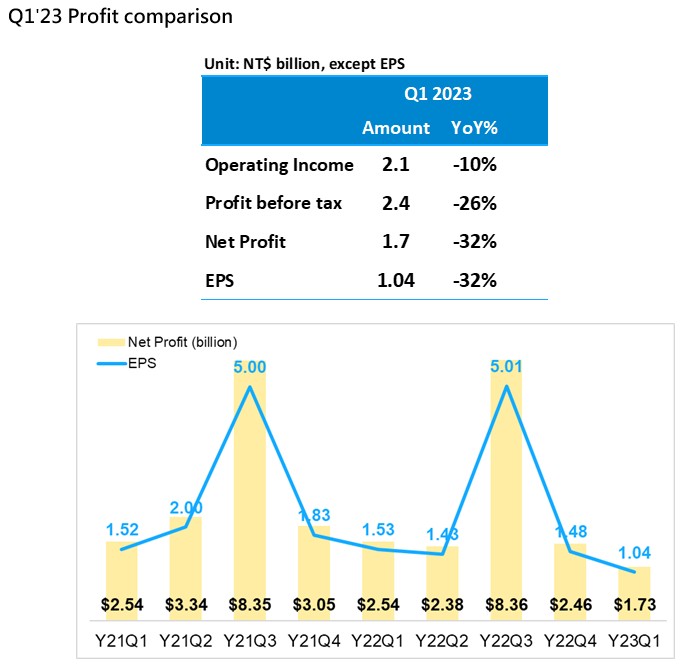

Synnex (2347) experienced a decline in revenue during the first quarter, primarily due to a significant slowdown in consumer product market demand. The revenue dropped by 12% compared to the same period last year, amounting to NT$88.6 billion. Additionally, the after-tax net profit was negatively affected by inflation and interest rate hikes, resulting in increased operating expenses and interest expenses. The after-tax net profit decreased to NT$1.73 billion, marking a 32% annual decline, with earnings per share at NT$1.04.

The decline in Synnex's first-quarter revenue was mainly attributed to a sharp decrease in the IT Consumer products sector. However, the IT Commercial business and Semiconductor business remained relatively stable. The overall poor economic situation had a negative impact on consumer confidence in the end market, leading to a 30% decline in the IT Consumer business and a 12% decline in the Telecom business during the first quarter. On the other hand, the IT Commercial business achieved a new high for the ninth consecutive quarter during the same period, setting a new record. The Semiconductor business demonstrated resilience due to the Management Service Platform, with only a slight 3% decline in the first quarter compared to the previous year, outperforming its competitors.

In terms of profitability, Synnex benefited from an increased proportion of revenue from IT Commercial businesses. In the first quarter, Synnex achieved a gross profit margin of 4.83%, the second-highest quarterly level in the past 15 years. This improvement in gross profit margin allowed Synnex to maintain a high level of gross profit, even with declining revenue compared to the same period last year. The operating income was affected by the increase in operating expenses due to inflation, resulting in a decrease to NT$2.07 billion, representing a 10% annual decline. Before-tax net profit also fell to NT$2.40 billion, a 26% annual decrease, due to the sharp increase in interest expenses resulting from interest rate hikes and the cessation of recognition of joint venture income in the US. After-tax net profit amounted to NT$1.73 billion, and earnings per share were NT$1.04, marking a 32% annual decrease.

In terms of inventory depletion, Synnex continued to reduce its inventory level. As of the end of March, inventory amounted to NT$45.6 billion, a decrease of over 20% from the previous quarter, and a significant drop of 30% from the peak in the third quarter of previous year. Synnex will continue to carefully manage and control its inventory to maximize efficiency.

Looking ahead, Synnex recognizes the highly unpredictable global political and economic situation, anticipating that future challenges will become more severe. To adapt to market changes, Synnex will continue optimizing its operational capabilities, streamline operations, and implementing four major business strategies. Despite the cautious approach, Synnex maintains an optimistic outlook for its performance in 2023.