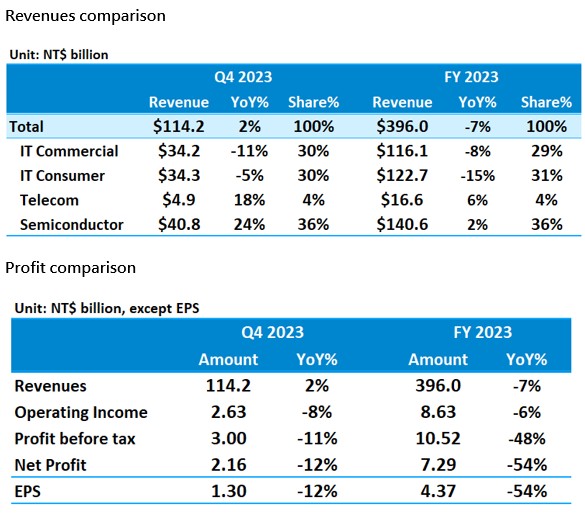

Synnex(2347) reported a revenue of NT$396.0 billion last year, accompanied by an after-tax net profit of NT$7.3 billion and earnings per share of NT$4.37. The board also passed a resolution to declare a cash dividend of NT$3.0 per share.

Despite a sluggish market recovery following the initial unsealing last year, which failed to stimulate anticipated demand growth, Synnex experienced a 7% decrease in revenue. However, thanks to optimized product portfolios and enhanced operational efficiency, its gross profit margin of 4.44% and operating income margin of 2.18% surpassed those of 2022, reaching the second-highest levels in nearly 20 years. This highlights the sustained enhancement of Synnex's profitability.

In terms of pre-tax net profit, adjustments in investment recognition methods in the previous year, coupled with the high-interest environment of last year, led to a significant decline in profitability year-on-year. Nonetheless, Synnex maintained its pre-tax net profit above NT$10 billion for the fourth consecutive year, reaching NT$10.5 billion. In terms of non-operating and investment income, Synnex recognized non-recurring valuation gains of NT$11.2 billion and NT$8.8 billion in 2021 and 2022, respectively, due to the adjustments, which also affected subsequent recognition of investment income under the equity method. This was the primary reason for the year-on-year decrease in pre-tax net profit last year.

Regarding interest expenses, the high-interest environment resulted in a notable increase in Synnex's interest expenses last year. However, starting from the second quarter of last year, Synnex has proactively reallocated its capital, effectively managing interest expenses.

Since the beginning of this year, driven by the enthusiasm surrounding AI, market sentiment and terminal demand have shown improvement compared to the previous year. Synnex achieved consecutive historical records for January and February revenue, totaling NT$68.7 billion for the first two months. This 28% increase from last year and new high for the same period mark a promising start to this year. With the completion of the change in investment recognition methods two years ago and the market consensus anticipating gradual decreases in interest rates this year, coupled with Synnex's ongoing improvement in profitability, optimism abounds for simultaneous growth in revenue and profits this year.