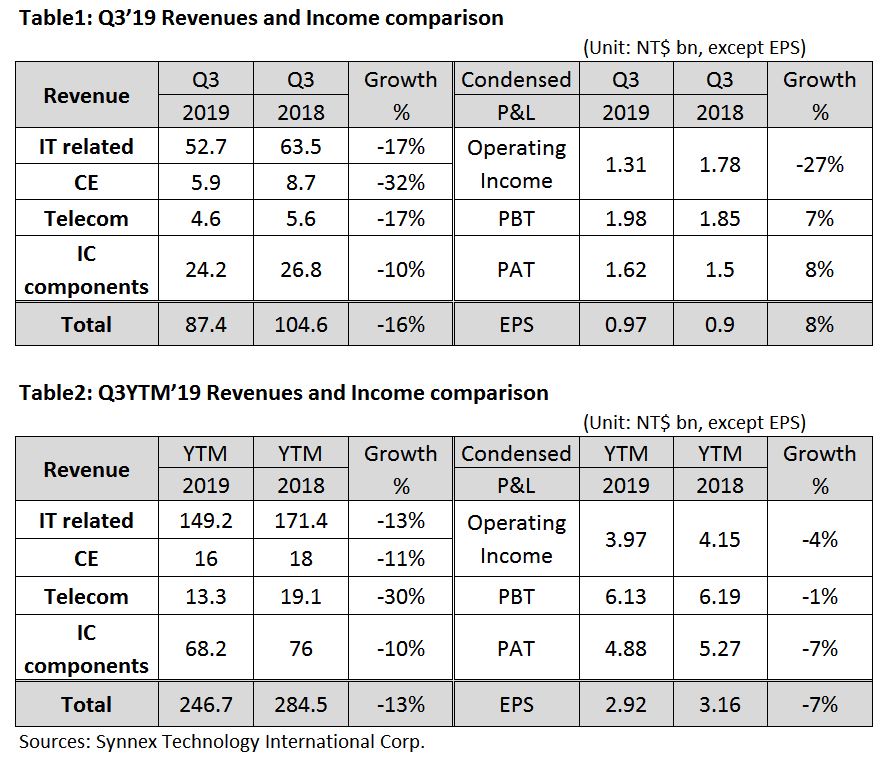

The performance for Q3’19 after CPA reviewed: Consolidated revenue was NT$87.4bn, dropped by 16% YoY. Profit after tax was NT$1.62bn and EPS was NT$0.97, grew by 8% YoY. YTM revenue accumulated to NT$246.7bn, profit after tax was NT$4.88bn, and EPS was NT$2.92.

Synnex showed that in the third quarter, the market continued to be affect by China-US trade war and circumstances of geographic politics and economy, resulting lack of consumer confidence, and leading in a 16% drop in revenue compared to last year's historical high. However, the profit performance was relatively excellent. This is due to the internal agility project has been implementing effectively and many profit indicators have continued to be improved. The overseas joint ventures have also performed well, resulting in a growth of 7% for PBT. PAT and EPS were also increased by 8% YoY.

For revenue aspect, the decline of revenue is mainly resulting from China market and consumer market, while the other regions and products remained relatively flat during Q3. Mobile phone business and Commercial market performed well due to new phone launch and the sales exceeded expectations. At the same time, government and corporation keep steadily investing in IT. If excluding China market, the revenue grew by 8% and 19% relatively. IC component business fell 10% due to weak China market and Intel CPUs shortage.

As for profit, owing to Synnex actively implement agility project and strictly manage all operation indexes since last year, as well as using AI big data analysis to optimize product portfolio and performance quality, making the gross profit margin and net profit margin continued to rise in Q3. Besides, the performance of overseas joint ventures were excellent in Q3, with a 28% increase in investment revenue, leading a 7% growth of PBT, and EPS was 0.97.

Accumulated to Q3’19, revenue dropped 13%, while both gross profit margin and gross profit increased compared with the same period last year. Profit before tax was NT$6.13bn, slightly dropped by 1%. If eliminating one-time profit NT$0.73bn from disposal partial of shares in Synnex Corporation (US) last year, profit before tax grew significantly by 12% YoY. YTM EPS was NT$2.92.