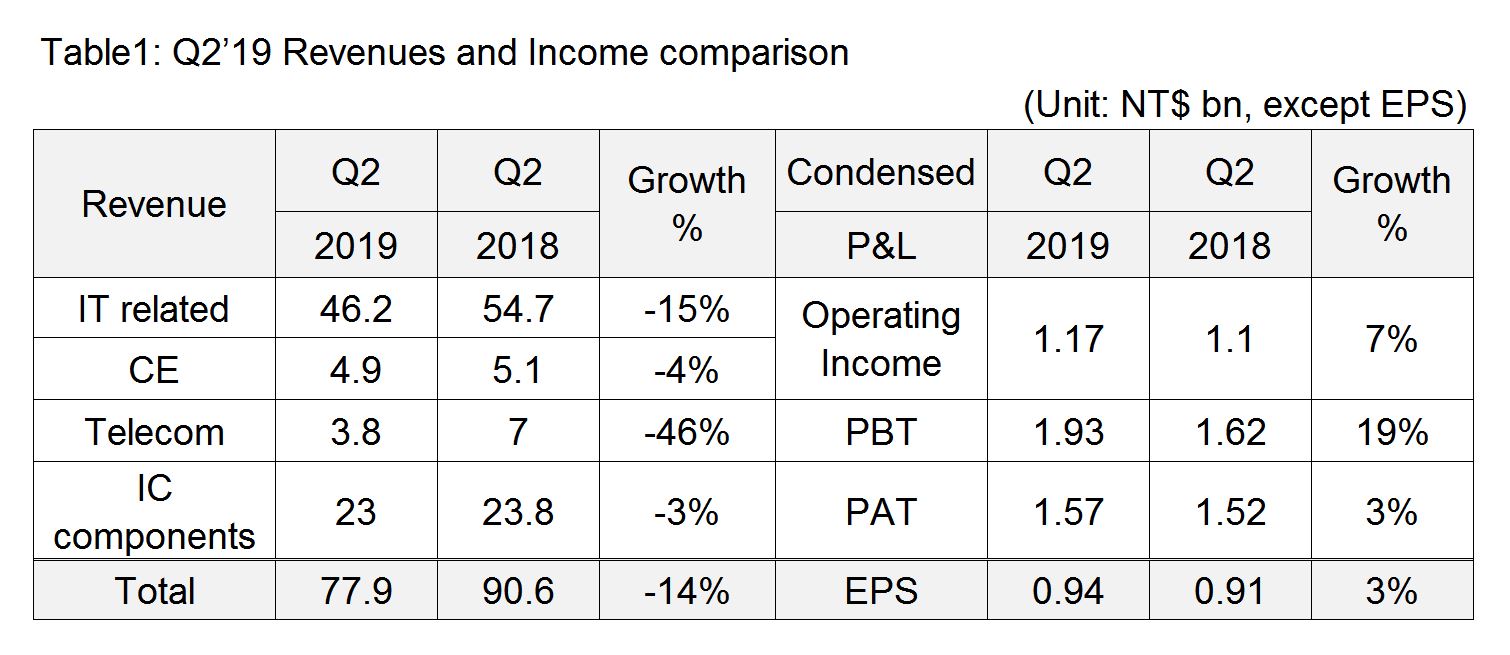

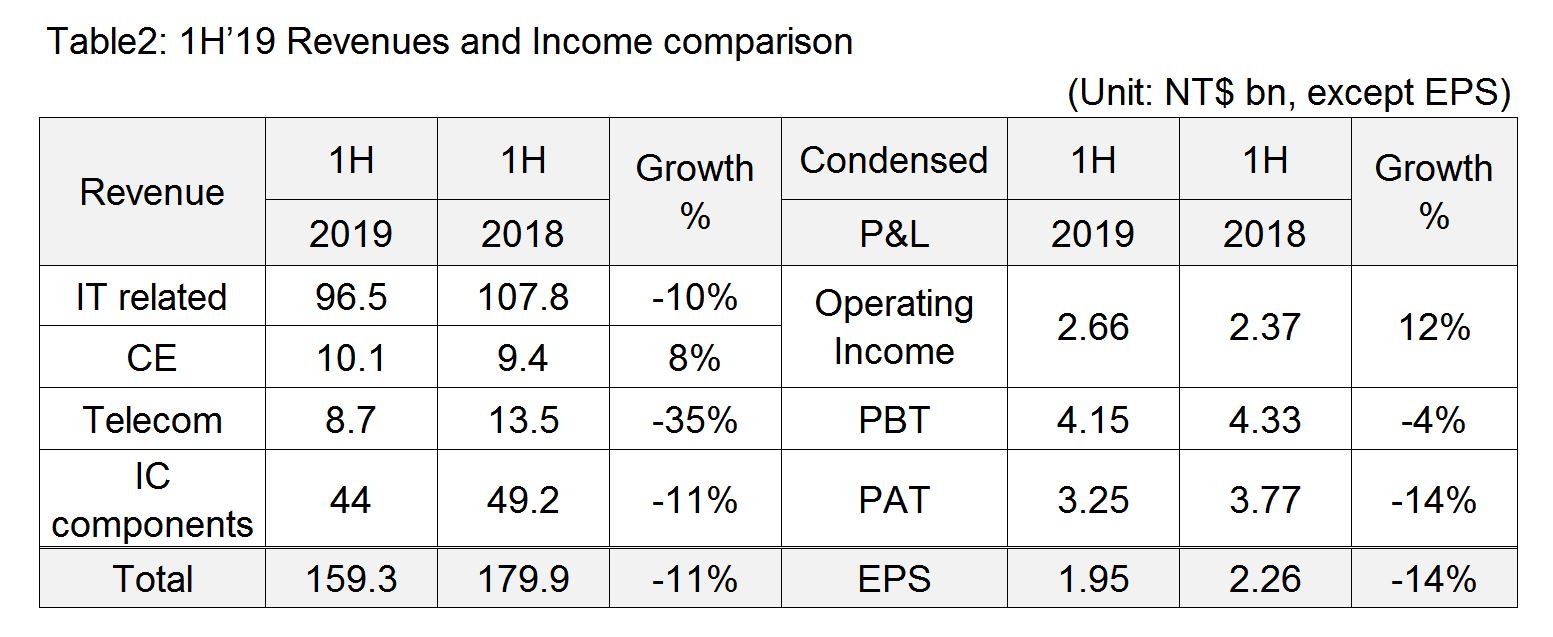

The performance for Q2’19 after CPA reviewed: Consolidated revenue was NT$77.9bn, dropped by 14%. Profit before tax was NT$1.93bn, grew by 19% YoY. Profit after tax was NT$1.57bn and EPS was NT$0.94, grew by 3% YoY. Y191H revenue accumulated to NT$159.3bn, profit after tax was NT$3.25bn, and EPS was NT$1.95.

Synnex showed that the second quarter affected by economic environment slow down, and lack of consumer confidence, leading revenue declined 14%. For profit performance, Synnex aggressively implemented operation agility project and strictly controlled all performance indexes, bringing operating income grew 7%, profit before tax significantly increased 19%. Profit after tax and EPS both grew 3% from prior year.

For revenue aspect, Y19Q2 China and mobile phone business both significantly declined. If excluding China and mobile phone business, other area revenue was relative stable with 4% decreased. Among them, Indonesia and Hong Kong achieved double digit growth, and Taiwan as well as remained previous year level. From product aspect, consumer market dropped 12% due to weakening end user demand. Commercial market grew by 17% exclusive of China market, resulting from continuous investment in internet security and digital transformation by enterprises and government. IC component business Y19Q2 revenue recovered previous year level, mainly due to manufactures gradually finished the adjustment for capacity allocation, in the meantime, new business application field also grew stably.

As for profit, owning to Synnex implemented internal digital transformation in prior year, aggressively applied AI big data analysis to enhance operation efficiency, and conducted agility project to optimize product portfolio and business quality, as well as strictly managed all operation indexes and decreased risk, bringing Y19Q2 operating income remained the growth momentum from prior year, grew by 7% YOY, profit before tax significantly increased 19%, and EPS was NT$0.94.

Accumulated to Y191H, operating income grew 12%, profit before tax was NT$4.15bn, drop by 4%. If eliminating one-time profit NT$0.73bn from disposal partial of shares in Synnex Corporation (US) last year, profit before tax grew by 15% YoY, and Y191H EPS was NT$1.95.

Looking forward to Y192H, since there is no clear and concrete development of trade war and geopolitics and economic situation continues to turmoil, Synnex hold conservative attitude toward market opportunity in second half year.

In addition, BOD have resolved and declared cash dividend of NT$2.0 per share for 2018, and set the ex-dividend trading date on August 23rd.

Sources: Synnex Technology International Corp.

Please visit www.synnex-grp.com for further information.