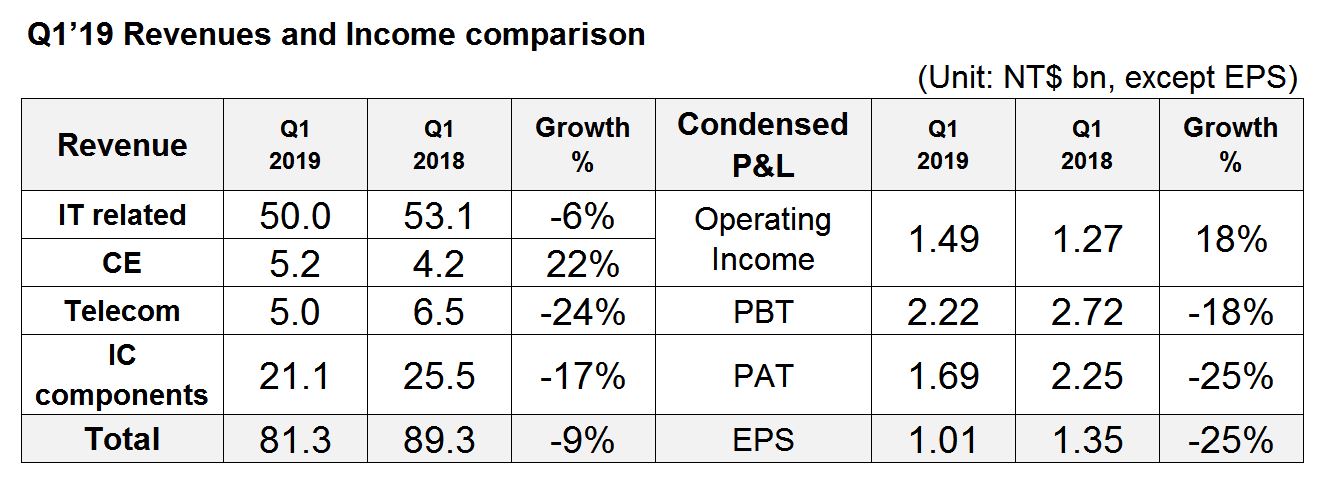

The performance for Q1’19 after CPA reviewed: Consolidated revenue was NT$81.3bn, down by 9% YoY, but significant increase in gross margin led operating income grew by 18% YoY. Profit after tax was NT$1.69bn and EPS reached NT$1.01.

Synnex show that the first quarter affected by economic environment slow down, and could not extend growth momentum from prior year. Revenue scale achieved above NT$80bn level, reaching the second highest record in the same period. For profit performance, due to continuous growth in commercial market, double growth in eSports revenue, as well as Synnex aggressively implemented lean projects, optimized product portfolio and reinforced performance quality, leading gross margin ratio grew by 23% YoY in Y19Q1, reaching new high record in 12 years. Operating income also increased significantly with 18% YoY. Profit after tax was NT$1.69bn and EPS came to NT$1.01.

For revenue aspect, Y19Q1 distribution business revenue was NT$60.2bn, although achieved second highest record with NT$60.0bn level, but dropped by 6% comparing to the same period in prior year, mainly due to waning demand from mobile phone and consumer IT products. Commercial, consumer related products and eSports market grew over 20% YoY owing to continuous investment in digital transformation by enterprise and government. IC component business revenue was NT$21.1bn, with decline of 17% YoY, mainly from trade war and unsolved problem in intel CPU shortage, causing manufacturing schedule became more conservative

As for profit, Y19Q1 gross margin ratio, gross margin amount and operating income all performed well. Profit after tax was NT$1.69bn, grew 26% QoQ, and down 25% YoY. If eliminating one-time profit NT$0.73bn from disposal partial of shares in Synnex Corporation (US) last year, profit after tax still rose by 11% YoY.

Looking forward to second quarter, since there is no clear and concrete development of trade war and uncertain factors still exist, Synnex hold conservative attitude toward market opportunity. As result of Synnex continuously implement lean plan, and optimize operating quality, Synnex still expect to keep high profit ratio from previous quarter.

In addition, BOD have resolved and declared cash dividend of NT$2.0 per share for 2018.