Synnex (2347) made a big leap forward in earnings, overwriting historical records for three consecutive quarters! Synnex's after-tax net profit for 1H was NT$5.9 billion and earnings per share of NT$3.52, both are historical high and a substantial growth of 64%. For second half outlook, as the market has entered the traditional peak season, in the meantime Synnex's July revenue also continued the strong momentum in the first half, and continued to stand at the 30 billion mark. Synnex is optimistic expect that the revenue and profit in the second half will exceed the first half, keeping reach out new records.

Thanks to the good result on the Agility Project, Synnex's profitability has substantial progress in recent years, various profit indicators have been reaching record high repeatedly. Since this year, Synnex has been accelerated building MSP (Management Service Platform) to enhance the breadth and depth of information exchange and sharing within entire supply chain through digital optimization and business operation automation. On top of that, Synnex also fully utilize her AI analysis capability and mobile service APP to response market dynamic and customer need rapidly. “It will also make the engagement within entire supply chain more close and solid” Synnex said.

In addition, Synnex's oversea joint ventures in US/Japan, India/MEA, Thailand and Vietnam also have outstanding performance, the JV income in first half have increased by more than double digits. In which, India/MEA significantly increased 2.8 times; US/Japan grew around 80%; Thailand and Vietnam also grew over 30%.

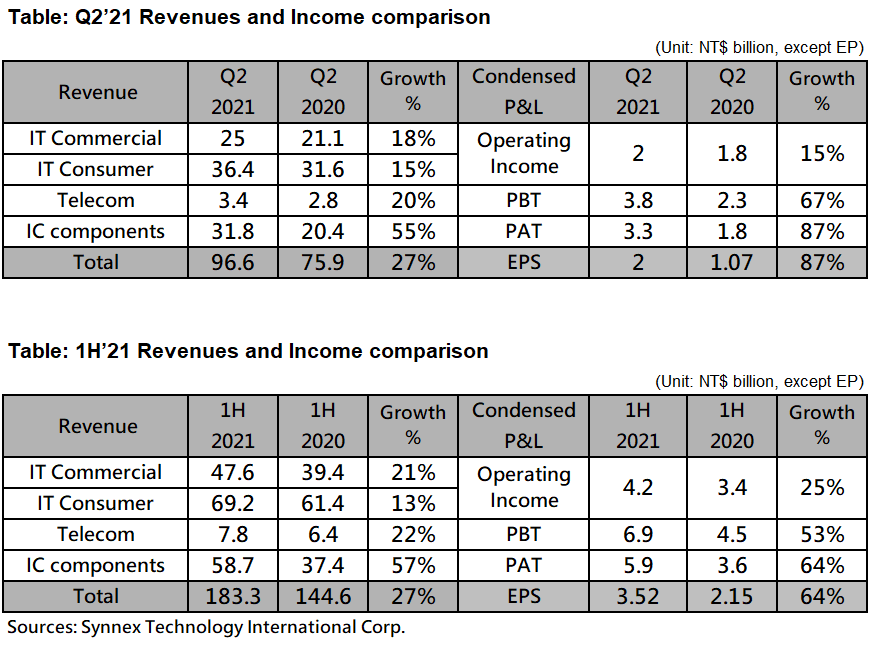

In the first half, Synnex's all indicators of gross profit, operating income, before-tax and after-tax net profit, and earnings per share, all reach out half-year historical record. Gross profit was NT$8.1 billion, up 17% YoY; operating income was NT$4.2 billion, up 25%; JV investment income was NT$1.4 billion, substantial increased by 53%; after-tax net profit was NT$5.9 billion and earnings per share of NT$3.52, both with a substantial growth of 64%. In addition, the before-tax net profit ratio of 3.76% and after-tax net profit ration of 3.20% are also record highs.

Synnex's Q2 performance was also quite impressive. Gross profit and operating income both reached new highs over the same period, increased by 13% and 15% respectively. JV investment income reached a record high for the same period in four consecutive seasons, reaching NT$760 million, increased by 180%. Before-tax net profit was NT$3.8 billion or 3.98%, which simultaneously set a record high in a single quarter, with an annual increase of 67%. After-tax net profit was NT$3.3 billion, a substantial increase of 87%; the net profit ratio was 3.45%, breaking through 3% for the first time, and both set a single-quarter high. Earnings per share of NT$2.00 is also a record high.

For second half outlook, in terms of top line, Synnex believes that in post-epidemic era, the rigid demand for ITC products by consumers and enterprises will maintain sales momentum. In addition, the launch of new iPhones, Microsoft Window 11, and new nVidia GPU will drive upgrade and refresh demand, market can be expected to flourish. In terms of profitability, Synnex continues to optimize its product portfolio to increase gross profit, and through digital optimization and AI analysis to improve internal operating efficiency and control operating expenses. With the blessing of favorable internal and external environments, Synnex is optimistic that it will have high chance keeping reach record high in second half and whole year.