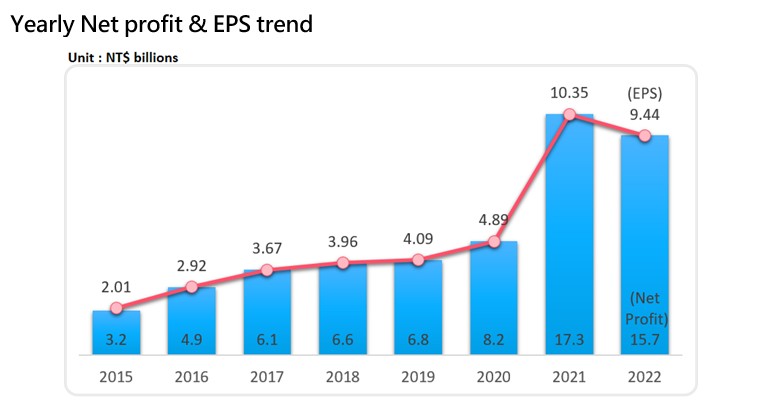

Synnex (2347) last year had a revenue of NT$424.6 billion, setting a new record in history; after-tax net profit reached NT$15.7 billion, exceeding the NT$10 billion mark for two consecutive years, and earnings per share of NT$9.44, the second highest in history. Dividend of NT$3.5 per share. In recent years, Synnex has actively optimized its operating system and vigorously promoted digital transformation, which are the main factors for the continuous high revenue and profit.

Affected by inflation, interest rate hikes, and geopolitical conflicts last year, terminal consumption and corporate investment have become more conservative since the second half of the year, resulting in a sharp freeze in market demand and challenges to companies. Due to its advanced deployment, Synnex has been making every effort to transform its operating system and promote digital transformation since before the epidemic. Therefore, even though it encountered market headwinds in the second half of last year, Synnex continued to record high revenue and profits.

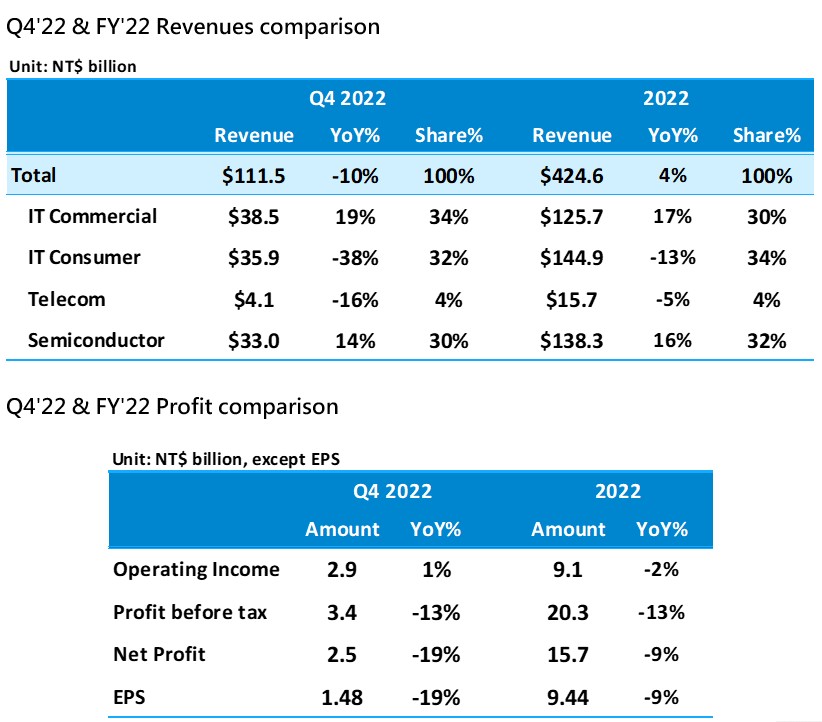

Synnex's revenue grew quarter by quarter last year, with the fourth quarter reaching a record high of NT$111.5 billion; gross profit and operating income in the fourth quarter reached record highs in a single quarter, reaching NT$5.1 billion and NT$2.9 billion respectively. The pre-tax/after-tax net profit and earnings per share were NT$3.4 billion, NT$2.5 billion, and NT$1.48, respectively, which are also highs in recent years. At the same time, Synnex is also committed to inventory optimization. At the end of last year, the inventory level has dropped by more than 10% from the high point in the third quarter, and it continues to accelerate its depletion.

Accumulated full-year performance in 2022, gross profit of NT$17.8 billion hit a record high, operating expense ratio remained at a historical low of 2.05%, and operating income of NT$9.1 billion. The before-tax net profit continued to reach the level of 20 billion, reaching NT$20.3 billion, the second highest in history. However, due to the impact of interest rate hikes, a sharp increase in interest expenses, and the accounting treatment change of investments, it fell 13% from last year. The after-tax net profit was NT$15.7 billion, exceeding the 10 billion mark for two consecutive years; the profit per share was NT$9.44, a big profit of nearly one share capital. Dividend of NT$3.5 per share.